If you are finding ways to register your Michigan LLC then you must make yourself aware of its process. It is nothing complicated. Although you can easily understand how to start an LLC in Michigan once you read our guide. It is only to give you an idea about how to move forward and what needs to be done along with an idea of how much it may cost you. Let us get straight into it.

How to Start an LLC in Michigan?

You will get the exact information on how to start an LLC in Michigan with just 5 steps process. If you do it right, it is a very easy process and you can smoothen your process with our guide. It is always helpful to keep your documents ready in one file. Also, note that these steps are helpful whether you are looking to create a domestic LLC or a foreign LLC.

- Michigan Business Entity Search

- Choose Your Registered Agent

- File the Michigan LLC Articles of Organization

- Create Your Michigan LLC Operating Agreement

- Get Your Michigan LLC EIN

Now, let us take a look at a few important details for Michigan LLC.

| The Form | Articles of organization |

| Agency | Michigan Secretary of State |

| Filing Fee | $50 |

| Online Filing | Available |

| Franchise Tax Report Due Date | February 15 |

| LLC Name Reservation Fee | $10 online/paper filings |

| Michigan LLC Fees | $50 online/paper filings |

Step 1- Michigan Business Entity Search

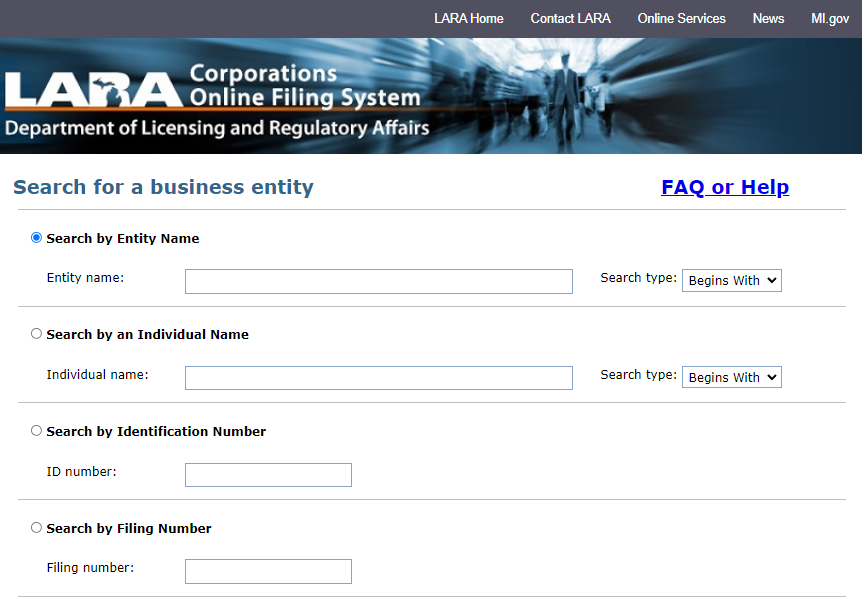

To start your Michigan LLC, you are required to do a Michigan business entity search. You can find this tool on the Michigan secretary of state’s website. They are specifically available to the public so that anyone thinking of starting an LLC can find a name for his or her business. To find a name for your LLC, think of a name and then search it on the Michigan SOS name search tool.

Now to think of a name that is valid and legit in the state of Michigan, you must follow their naming guidelines. The foremost requirement is to think of a name that is unique and not in use currently in Michigan.

- Your name should end with phrases like L.L.C., LLC, Limited Liability Company, Limited Company, LC.

- Your LLC name should not use words that may indicate your LLC as a government agency.

- Commencing a bank, university, the clinic will require special licenses & permits.

- Using accent marks above the LLC name will not distinguish it from others.

- The state will not see the upper case and lower case as distinction.

After choosing the available name, you can choose to reserve your LLC name. It is only optional to do so but it will protect the name from other businesses. If you choose to reserve, you can pay $10 or $25 for 120 days depending on your entity. You can fill out the name reservation form online and print it out.

We recommend you choose multiple names at first for a smoother process. If one name is not available you have a backup name to go for. Also, choose a name that identifies your business correctly.

Step 2 – Choose Your Registered Agent

To have an understanding is different and to have an experience is different. Hiring a registered agent could be very helpful. There are trained professionals who know how to start an LLC in Michigan and know what kind of situations to expect. This will speed up your process and at the same time, you will not have to worry about missing out on any vital document or step.

Who can be your registered agent?

Only Michigan State residents can be selected as registered agents. He/she should know all the legal notices that they have to send to the state government. They will also receive the documents from the state government so they must be able to answer those lawsuits. You can select anyone as your registered agent besides he/she knows all the lawsuits.

- You can become a registered agent for your LLC.

- If you want to select anyone from your LLC then you can select them too.

- Anyone from your family or friend can become your registered agent.

- Professional registered agents are there, so you can choose them.

We recommend you to get a registered agent as they are professionals and trained specifically for this. A registered agent can maintain and file the documents to start your Michigan LLC.

Step 3 – File the Michigan LLC Articles of Organization

A very important document every LLC must file to be formed in Michigan. This document will hold all information about your LLC. There is a different forms for Michigan domestic LLC and Michigan foreign LLC. File and you can commence your operation in Michigan. The filing fee is $50 with the LARA Department of licensing & Regulatory Affairs. You can file online or by mail.

Mailing Address

- Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau — Corporations Division

P.O. Box 30054

Lansing, MI 48909

Office Address:

- Michigan Department of Licensing and Regulatory Affairs

2501 Woodlake Cir.

Okemos, MI 48864.

We recommend you complete the article on organization carefully & you should go for the online method for quick processing. Having a registered agent can help you file the right document and save time.

Step 4- Create Your Michigan LLC Operating Agreement

You must have Michigan LLC Operating Agreement to maintain the smooth flow of operations. It is not a necessary document for every state. Although it is much more helpful if you create it. This agreement is internally created and can be helpful to overcome future conflicts. While creating this, you should keep a few details included like:

- Name of LLC

- Address of LLC

- Effective Date

- Name and address of the registered agent

- Registered office address

- Contact of registered agent

- Name and contact of each member

- Management of the firm

- Share and capital of each member

- Rules and rights for each member

- Dissolution date

We recommend you get the operating agreement after forming your Michigan LLC. Not compulsory by the government but it can be of great tool to help you to maintain and grow your LLC.

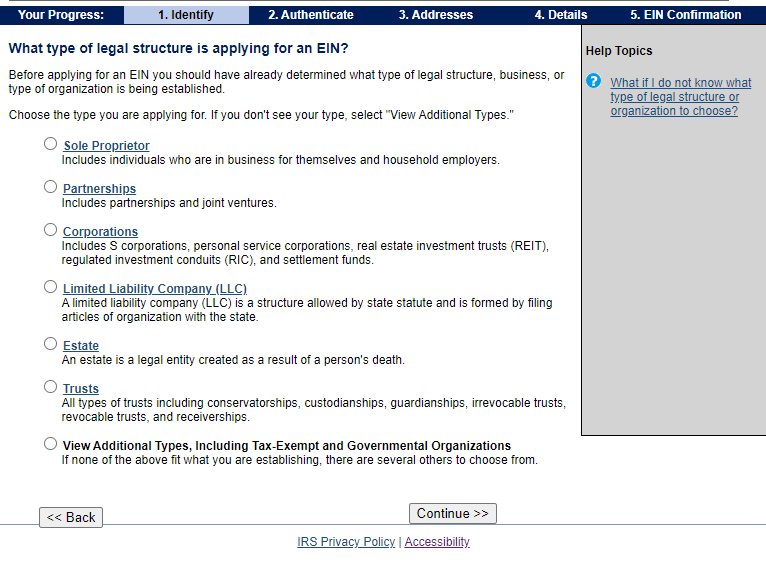

Step 5- Get Your Michigan LLC EIN

Getting the Employer Identification Number is very necessary for your Michigan LLC. An EIN can be filed online and very quickly. You will find the EIN form on the IRS website. You do not have to pay any charges for it. Apply only when your LLC is formed. Here is why you should get an EIN?

- You should have a business account for starting a business and so to open the business bank account you have to provide the EIN.

- All the federal and state taxes can be managed by having employer identification numbers.

- If you want to get more new employees in your Michigan LLC then you must have the EIN.

We Recommend you to get the Employer Identification Number because it can hold up your day to day operations as it won’t let you hire employees. Therefore it is very important.

Michigan Foreign LLC Registration

If you are willing to expand your LLC in any other state other than your existing state, then you must form a foreign LLC. To form the Michigan foreign LLC, you will need to fill out an application online and then print it out. You will need to pay an amount of $50 as filing fees. Send the documents to the below address.

Mailing Address:

- Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

P.O. Box 30054

Lansing, MI 48909

How to Obtain a Certificate of Good Standing in Michigan?

A certificate of good standing is necessary if you are willing to grow your business in any other state. You can get this document from the official LARA licensing and Regulatory Affairs website. Here are some of the instances where you will require to have a certificate of good standing.

- If you want to expand your business then you will have to invest some money, so if you go to the bank then you will have to provide the Certificate of good standing to get the loans.

- It is required if you are willing to form your LLC in any other state to expand it.

- You must have it at the ti,e of renewal of license and permit.

What’s Next After Filing Michigan LLC?

After forming your Michigan LLC, there are a few things that must be focused on. It is not a part of the process but it will only help you to run your Michigan LLC smoothly. Here is what you should consider doing.

Set Up Your Finance & Accounting

As soon as you complete the formation of your LLC, setting up your finance and accounting is useful. To successfully run the financial side of your Michigan LLC, you will need to take some actions like:

Separate Business & Personal Expenses – Keeping your personal and business assets together could be a risk in the future. If you will keep your personal and business accounts separate then it can help you to keep your assets safe. It can also help to manage your money more effectively.

Consider a Small Business Credit Card – It is smart to consider getting a business card once you complete establishing your Michigan LLC. You must know which credit card is right for you and what things must be seen or examined to choose it. During the initial period of your business factors such as 0% intro APR can help your business to carry an interest-free balance.

Set Up Accounting Software – You can track your account receivable if you are having the right business accounting software. It also helps to track the money that is flowing in or out of your business. To simplify the year-end tax burden of your Michigan LLC this can be considered an important document.

Know Your Taxes

Your Michigan limited liability company will also be liable for paying taxes. To remain in good standing with the state, you must file all the taxes on time. There are different forms of taxes that may vary from one state to another and also depending on the type of entity. Here are the most important ones:

- Sales tax – If you are a seller and want to sell various things in your Michigan LLC, you must have a seller’s permit. Sales tax must be filed so that you can take tax on the taxable goods.

- Employer taxes – You have to file/register for unemployment insurance tax if you are having or are willing to hire employees in your firm.

- Federal requirement – All the LLCs in Michigan have to file an annual statement with IRS. It depends on how you pay all the taxes as an owner.

Hiring Employees

Hiring employees is a part of the process, to run a business. Before you hire for your Michigan LLC, you should know a few things.

- You should verify that the employee is able and allowed to work in the USA.

- To hire the employees, you have to report them as “new hires”

- For employees, you have to provide worker’s compensation.

- Withholding employees tax.

- You have to print out the workman compliance poster and place them in the visible area near your workplace.

File Your Annual Report

The annual report is a statement that you have to file with the state government every year. In this report, you have to notify the government regarding various changes in your business. It must be formed every year. If you will not file it on time then you must pay a penalty. To file your annual report you have to pay $25 as a filing fee to the Department of Licensing and Regulatory Affair.

- Filing Fees – To file that you should pay $25

- Due Date – February 15 each year

- Late Filing penalty – $50

Frequently Asked Questions

1. What is the time is taken to start an LLC in Michigan?

It can take up to 3 to 5 business days to get the confirmation after completing the filling and submitting it.

2. How to change the name of the Michigan LLC?

It can be done by filing Articles of Organization if you want to make any changes in domestic LLC. You will have to submit the Certificate of Amendment.

3. What is the cost to form Michigan LLC?

You have to pay $50 if you want to file for Michigan LLC.

4. Does I need EIN for my LLC?

If you are willing to hire employees and paying tax then you must have EIN.

5. Can a member of LLC be a registered agent?

Yes, he/she should know all the lawsuits & how to file the forms & documents to the Michigan State government.