Choosing a business type is the primary step when you think about establishing any business. As per surveys, over 35% of US businesses are LLCs. It is beneficial for entrepreneurs as it combines the benefits of partnerships and corporations. New Jersey is one of the most suitable states to start your dream business. So how to start an LLC in New Jersey? Here’s everything you need to get your New Jersey LLC on track.

How To Start an LLC in New Jersey?

There are 5 simple steps you need to follow if you want to start your New Jersey LLC. It requires registering your business as an LLC with the New Jersey Department of State. But first, you should be aware of certain requirements. For domestic & foreign LLCs, the formation document may vary but the process will be the same. Just follow these steps.

- New Jersey Business Entity Search

- Hire a Registered Agent

- File the New Jersey Certificate of Formation

- Create an Operating Agreement.

- Get the EIN number for your LLC.

| The Form | Certificate of formation |

| Agency | New Jersey Department of State |

| Filing Fee (Domestic/Foreign) | $125 |

| Registered Agent Fee | Around $49 |

| Online Filing | Available |

| Franchise Tax Report Due Date | April 18 |

| New Jersey LLC Name Search | Free |

| LLC Name Reservation Fee | $50 |

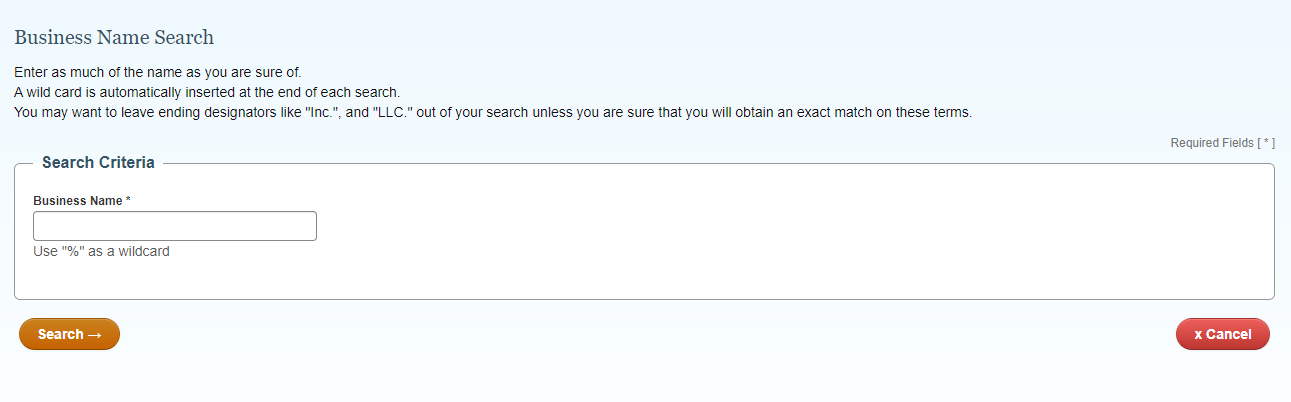

Step 1: New Jersey Business Entity Search [FREE]

It is indeed important to choose a valid and legal name for your LLC. Also, the name must be unique and distinguishable from the other existing business. To ensure this you have to follow New Jersey state guidelines and do the New Jersey business entity search. This tool is available on the official website of the New Jersey Department of State.

New Jersey LLC naming guidelines

New Jersey LLC naming guidelines

- Your name should have “limited liability company” or its short form (LLC, L.L.C) at the end.

- Avoid using words that confuse your LLC with government agencies such as the FBI, Treasury, etc.

- Restricted words like bank, attorney, school, etc require approval or a license.

- Adding articles and symbols to your name doesn’t distinguish it from existing names.

Name Reservation: Make sure to reserve an LLC if you aren’t intending to form one right away. New Jersey allows name reservations for 120 days at a cost of $50. The reservation form must be electronically submitted to the New Jersey Division of Revenue and Enterprise Services.

We also recommend checking the domain name availability. Nowadays most businesses have their own websites to engage with customers. Even if you do not intend to create a website right now, you can reserve it for the future by purchasing now. You should always choose a domain name same as your LLC name.

Step 2: Choose Your Registered Agent [Around $49]

Every New Jersey LLC is required to have a registered agent to receive legal documents sent by the state department. Your New Jersey registered agent will ensure that you don’t miss out on crucial paperwork and help your LLC stay in compliance with state laws. So choose someone who is eligible and has experience.

Who can be your registered agent for New Jersey LLC?

You can choose your registered agent from within or outside your LLC. It can be you, any of your partners, colleagues, a family member, or a close friend. You may also hire a professional firm operating in various states.

In the end, you must look out that your registered agent follows the state guidelines as follows:

- The agent must be a New Jersey citizen who is above 18 years.

- A professional firm must have the right to provide service in New Jersey.

- Both an individual and an entity must have a physical street address.

- Your own business is not eligible for being a New Jersey registered agent.

The fees for registered agents may vary between $49 to $300 depending upon their experience and services. But many organizations provide free register agent service if you hire them to register your LLC.

Step 3: File Certificate of Formation [$125]

This is the main phase of the formation of New Jersey LLC. Your business is legally allowed to operate as an LLC once the Formation document is approved by the New Jersey Department of State. This is considered the official document for starting an LLC. Other states call this the article of organization or certificate of registration/organization.

You can submit this document online, by mail, or by physically visiting the New Jersey Department of State. Within 60 days of filing the certificate of formation, you must additionally submit the Business registration application. You can check out our New Jersey certificate of formation guide in advance. There is no cost associated with using this application but filing an article of organization will cost you $125. If you wish to get it done in one day you have to pay to expedite fee.

Online Filing: Visit the State of New Jersey

Mailing: NJ Division of Revenue, PO Box 308, Trenton, New Jersey

Office Address: NJ Division of Revenue, 33 W. State st. Trenton

Step 4: Create Your Operating Agreement

The New Jersey DOS doesn’t legally require an operating agreement. However, maintaining a New Jersey operating agreement is a good practice and certainly a beneficial one. An Operating Agreement outlines your LLC’s ownership, management, and operating information.

It manages internal affairs, provides a solution to avoid future conflicts, and settles disputes among LLC members. You can add the following information in Operating Agreement.

- Name and physical address of your LLC.

- Duration of business and dissolution period.

- Details of the registered agent.

- Purpose of business.

- Procedure to add new members.

- Ownership, management structure, members’ details [names & address].

- Profit shares, effective dates, capital contribution, etc.

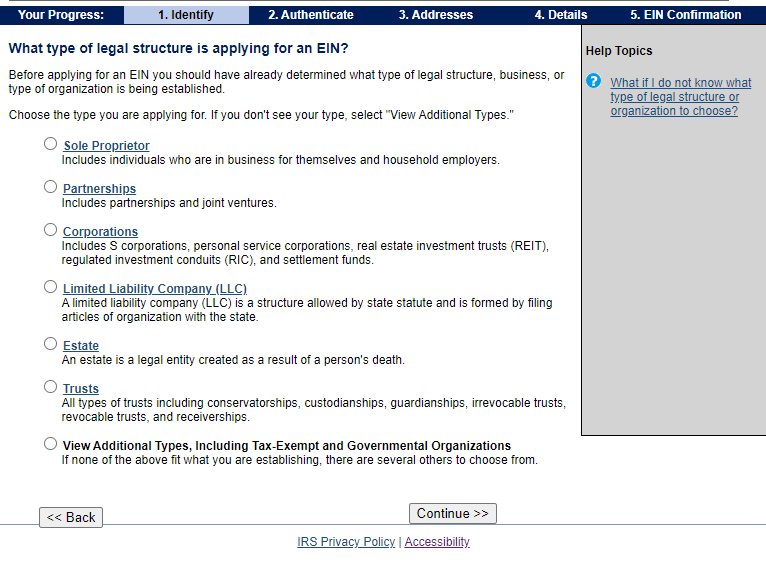

5. Get the EIN Number

Any New Jersey LLC having more than one employee or member must obtain an EIN number. It is the 9-digit number provided by IRS to recognize LLCs for tax purposes. You can easily get it online on the IRS website or download the form SS-4 and submit the hard copy to the IRS office, which is free.

Here is why EIN is important to obtain:

- Assist in filing and managing federal-level taxes.

- To open a business bank account.

- Perform various financial activities.

- Hiring employees for your LLC

How to Form a Foreign LLC in New Jersey?

To expand your existing LLC in another state you need to register as a foreign LLC. Similarly, In New Jersey also you can register your foreign LLC and operate your business. This can be done online or through the mail by submitting the application for a certificate of authority. A foreign LLC also has to attach a certificate of good standing dated within 30 days. The cost of filing this document is the same as a domestic LLC which is $125.

Online:

Visit the New Jersey Department of Treasury

Mail to:

New Jersey Division of Revenue

P.O. Box 308

Trenton, NJ 08646

How to Get a Certificate of Good Standing in New Jersey?

A good standing certificate is a document that reflects the status of the company. It shows the legal formation, maintenance, and taxes clearances of the LLC. Without a good standing certificate, you won’t be able to start a foreign LLC in NJ. There are two forms, a short-form certificate that cost $50, and a long-form certificate that costs $100. Some more reasons why you need a certificate of good standing are: to get funds from lenders, form a foreign LLC, or renew your licenses.

To be eligible for a good standing certificate, keep your company up-to-date with state compliance requirements like annual reports, state taxes, licenses, and permits. You can then order this certificate using the below information.

- Online: Visit the New Jersey Division of Revenue

- Fax: 609-984-6855

- Mail: Certification and Status Unit, NJ DORES, PO Box 450, NJ 08646

- Visit: Certification and Status Unit, NJ DORES, 33 West State Street

What To Do After Registering Your New Jersey LLC?

Registration of your LLC is completed after filing the certificate of formation. However, there are many things you should consider and focus on to stay compliant with the state and run the business smoothly. Here’s what you should focus on after forming New Jersey LLC.

Separate Your Personal and Business Assets

Mixing your personal assets and business assets is highly risky. Therefore, make sure you have separate personal and business bank accounts while operating an LLC. Here is why we recommend this:

- It helps you to pay accurate taxes and save time during tax season.

- Keep note of your LLC’s cash flow.

- Helps to maintain business credit rating.

You can hire an accountant or accounting software to manage your business financials. Getting accounting software reduces your expenses because you don’t need to pay the salary to an accountant. It also keeps the records more systematically.

Register Your Business for Taxes

Register your New Jersey LLC for taxes by submitting the Business registration application to the New Jersey DOS. This form needs to be submitted online or through mail within 60 days of filing the public record filing. New Jersey Department of State can fine you for not paying taxes on time.

Sales Tax – If your business is related to selling any physical product then you have to file sales tax. It is mandatory to register for a seller’s permit at the New Jersey Division of Revenue and Enterprise Services (DORES). Sales tax is also called “sales and uses tax”.

Federal tax – Paying federal tax is the way to report the income of your New Jersey LLC to the IRS. All the LLCs throughout the country have to pay federal tax unless you choose your LLC to be taxed as a pass-through. In pass-through taxation, members will distribute and pay tax based on their income.

Employer tax – If you have any employees or wish to hire in the near future you need to register for employer taxes. Employer tax is also called employer payroll tax which is deducted from the employee’s salary.

Get Your Business License

New Jersey doesn’t offer a general business license. Depending upon the type of LLC or business you establish, you may need to get a license or permit. Businesses in professions like doctors, lawyers, dentists, accountants, and engineers are required to get a license. To get a local permit contact the local county clerk. For state permits, visit the State of NJ Business Portal and for federal licenses, check out the SBA guide.

Get Business Insurance

When you establish a new business the most common way to secure it is to get insurance. Some of the insurance you should get are general liability insurance, professional liability, and worker’s compensation insurance. General liability insurance secures your business from lawsuits, professional liability insurance covers business errors and claims of malpractice. Workers’ compensation insurance covers sickness, accidents, etc.

Hire Employees

After the formation of a New Jersey LLC, you may need to hire employees to work and meet the company’s goals. Every LLC that hires employee need to stay compliant with the state as well as federal law. EIN number is mandatory to hire employees for your business. Some of the things you should keep in mind before hiring an employee in New Jersey are:

- Eligibility: You need to make sure the employee is authorized to work in the US.

- Employee reporting: A company must inform the New Jersey Department of Human Services about their new hiring within 20 days by filing reporting form.

- Employer withholding: Employers in New Jersey are instructed to deduct and withhold some amount from employee wages as a tax.

- Get workers’ compensation insurance: getting worker’s compensation insurance is mandatory for all New Jersey LLCs having employees. LLC members are not considered employees.

Furthermore, In New Jersey, it is advisable to maintain minimum wage and install workplace compliance posters in visible areas.

File Annual Report

All the LLCs in New Jersey have to compulsory submit the annual report to the Revenue Department. The range of filing is from $50 to $75. It is needed to disclose the company’s operating and financial records. The report must be submitted by the last day of the month in which the LLC was formed.

Frequently Asked Questions

1. What is the New Jersey minimum wage?

As per minimum wages law, the minimum pay for a worker is $13 per hour for a business with more employees and $11.90 per hour for an LLC having less than 6 employees.

2. Can I update the New Jersey certificate of formation?

Yes, you can update any information in the NJ certificate of information. For that, you have to file the Business Change and Amendment form. This service is free of cost.

3. How long does it take to approve New Jersey article of organization?

It may take up to one week to approve filing of the certificate of formation and legally form an LLC in New Jersey.

4. Is my operating agreement need to be filed with the state?

Unlike other states, in New Jersey You don’t need to file an operating agreement but it is a good habit to keep it for future references.