A limited liability company is by far the easiest way to legally structure your business. Different states have some unique rules for LLC formation and Pennsylvania is no exception. So how to start an LLC in Pennsylvania? For your convenience, here’s a stepwise process to forming a Pennsylvania LLC.

An LLC gives you both, the limited liability of a “Corporation” and the simplicity that comes with sole proprietorships.

How to Start an LLC in Pennsylvania?

Creating a Pennsylvania LLC is your best choice if you want to limit your personal liability for debts and lawsuits. All you need to do is file the Certificate of Organization with the Pennsylvania Department of State. This is the official document and a successful filing will officially create your Pennsylvania LLC.

Filing this document with the Pennsylvania SOS isn’t that difficult but there are certain things you must know while filling it up. So to make things simple, here are five simple steps to successfully starting your LLC in Pennsylvania.

- Find a Name for your LLC

- Appoint a Registered Agent

- File the Certificate of Formation

- Create an Operating Agreement

- Get EIN from the IRS

| The Form | Certificate of Organization |

| Agency | Pennsylvania Department of State |

| Filing Fee (Domestic/Foreign) | $125 |

| Registered Agent Fee | Starting from $49 per year |

| Online Filing | Available |

| Foreign LLC Annual Registration Deadline | April 15th |

| LLC Name Reservation Fee | $70 |

Step 1: Find a Unique Name for Your LLC

The first thing your need to do is finalize a name for your LLC. This is an important step as you can’t name a business out of the blue. You would want a name that’s catchy and easily searchable but it should also be unique from other registered entities and comply with Pennsylvania LLC naming rules.

PA LLC Naming Rules:

Just like any other state, Pennsylvania requires all registered businesses to have a unique name. This means the name of your LLC must be distinguishable from other firms already on file with the PA Department of State.

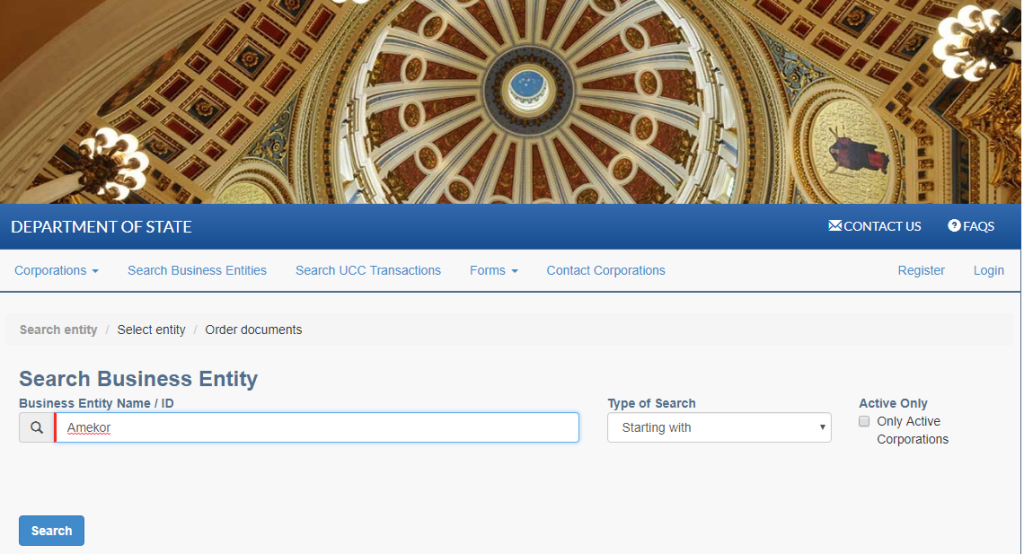

So you must check your name for availability on the PA business database. For your convenience, here’s how to perform a Pennsylvania business entity search and check for available names. Besides that…

- The name should have “limited liability company”, “Company”, or “Limited” at the end. (or any abbreviations of these).

- You must not use words that confuse your LLC with PA state or federal government agency…

- This includes (but is not limited) to Pennsylvania Police, FBI, State Department, Treasury, etc.

- In Pennsylvania, licensed professionals (health, chiropractic, dentists, physiotherapy, psychology, etc.) have to form a restricted professional company. Here are restricted professional services in PA.

Name Reservation: If your desired name is available, you may reserve it (Form DSCB:15-208) with the PA Department of State. With a filing fee of $70, your Pennsylvania LLC’s name will be reserved for 120 days. This will secure the name if you need time to build other resources for forming the LLC.

We also recommend checking if the name is available as a URL (web domain). Even if you don’t want to sell something online, you may want a website in the future. So buying the URL will prevent others from using it.

Step 2: Choose Your Registered Agent

Pennsylvania law requires businesses to designate an official mailing address (a registered office) in the formation document.

A registered office address (known as a registered agent in most states) is where the Pennsylvania state department will mail official/legal documents related to your LLC. It includes state filings, tax reports, and service of process during lawsuits.

The agent is your LLC’s only point of contact with the PA state. So choose one wisely. The agent could be a person or a company but here are the requirements.

- If it’s an individual, he/she must be at least 18 years old.

- The address should be a street location in Pennsylvania and must not be a P.O box.

- It can be the address of a Pennsylvania resident or an organization authorized to conduct business in the state.

Can a business address be the registered office?

As an owner of your LLC, you can choose your business address or home address (yours or any member/manager of the LLC). But we recommend signing a commercial registered office provider for better reliability.

Here’s a guide on Pennsylvania registered agent that’ll clear your all doubts.

Step 3: File Your PA Certificate of Organization

Once the name and registered office are ready, it’s time to submit the Certificate of Organization and a docketing statement to the Pennsylvania Department of State. In Pennsylvania, a Certificate of Organization (known as Articles of Organization in other states) is the main LLC formation document.

It requires every info. – LLC’s name, address of registered office, names of LLC organizers, etc. Through a successful filing, your business will have the authority to operate as an LLC in Pennsylvania. Here’s all you need to know about filling up the Pennsylvania Certificate of Organization.

How to File?

You may either file it online or send it to the state department by mail. Both require a filing fee of $125 (nonrefundable)

- You can fill up form 15-8821 and submit it online on the PA department of state website.

- Or, download the form and mail it to the address mentioned below. Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

You’ll also have to submit Docking Statement when filing by mail. (It’ll require your LLC’s EIN, tax year, and other details).

How Long will the Approval Take?

The state department may take a week or two to process the certificate of organization and approve your LLC. Upon approval, they’ll mail you a copy of the filed certificate. If rejected for any reason, you’ll get a chance for correction and refile.

Step 4: Draft an Operating Agreement for Your LLC (Optional)

Firstly, operating agreements are optional. It’s not mandatory to have an LLC operating agreement before or after forming your LLC. That said, having one is highly advisable because…

- It makes sure that all LLC members/owners are on the same page.

- Avoids future conflicts between members/owners.

- Sets clear rules for business operations.

An operating agreement is a document that outlines things like the ownership, rights, management structure, voting powers, roles, and responsibilities of members. Pennsylvania doesn’t require filing this document. It is just an internal LLC document that can be updated anytime with each member’s consent.

Your PA LLC’s operating agreement should at least have the following details.

- The products/services your LLC offers.

- Names and addresses of all the members.

- Who’s managing the LLC?: the members or a separate manager.

- Capital contributions from each member

- Each member’s level of ownership, voting power, and profit distributions

- Process of adding new members

- Positional changes when a member decides to leave

- Predefined terms and procedures for dissolution of LLC

We recommend checking our complete guide on Pennsylvania LLC operating agreement. It’s better to have professional help to avoid any mistakes in this document. Once it’s ready, all the members should review and sign it. You can keep the agreement at your business location with other documents.

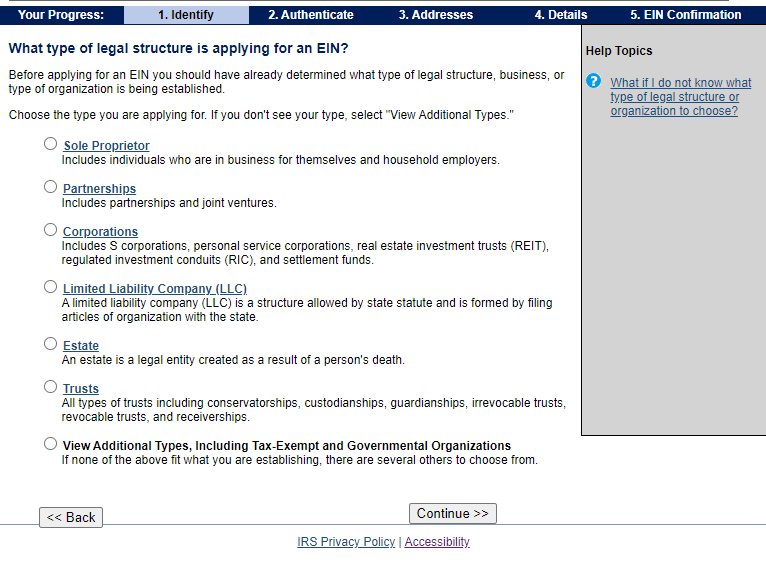

Step 5: Obtain Your EIN

EIN stands for Employer Identification Number and it is highly necessary to get if your LLC has more than one member (even with zero employees). EINs are 9-digit number and acts as social security number for your LLC. It helps the state identify businesses for tax purposes. Simply get your EIN online from the IRS’s website.

Here’s how EIN helps businesses in different ways.

- To hire employees.

- To open a business bank account.

- Qualify to get business loans

- Manage state & federal taxes

We recommend applying for an EIN online on the IRS website for faster processing. Both online and mail applications are free.

Pennsylvania Foreign LLC Registration

If you already running your LLC in different states and want a green flag to do business in Pennsylvania, then you’ll need to create a Foreign LLC in Pennsylvania. Instead of a typical Certificate of Organization, you’ll have to file a foreign registration of statement, which requires a filing fee of $250.

Foreign Professional LLC: Foreign LLCs offering professional services (health professions, psychology, dentistry, etc.) in PA also have to submit an Annual Registration with the Pennsylvania DOS. The deadline for this is 15th April of every year. This can be done by postal mail or online. You must also pay a filing fee of $560 times the number of LLC members.

Pennsylvania also allows for LLC domestication (transfer) – “transferring your LLC from the state where it was formed initially to a Pennsylvania.” For this, you’ll have to submit a Statement of Domestication which costs a $70 filing fee.

How to Get a Certificate of Good Standing In Pennsylvania?

A Pennsylvania certificate of good standing (also known as a Certificate of Substance) is a verification document that states your LLC/corporation is a legal entity that’s properly maintained (with timely tax filings) in the state. Note that LLCs in Pennsylvania are not obliged to have a good standing certificate. However, in some cases it’s helpful.

- Opening your business in another state as a foreign LLC

- Business license renewal

- Getting business loans

- Opening a business bank account

- Real estate purchases…etc.

So to take your business outside of Pennsylvania, you’ll have to register your LLC as a foreign LLC/entity. And for that, the state will first examine and approve your Certificate of Good Standing. Once that state approves it, you’ll get a Certificate of authority for your foreign LLC.

You can order your certificate of good standing online with a $40 filing fee. This is payable through a personal check or money order. It contains your LLC’s name, filing dates, successful tax filings, and a statement saying “the LLC or company is duly organized with the Commonwealth of Pennsylvania.

Next Steps After Creating Your Pennsylvania LLC

So, the state has approved your LLC formation, what’s next? The next steps include planning your finances, knowing your taxes, timely filing Annual Registrations (for professional LLCs only), and many more. Here’s what you need to do.

1. Plan Your Finances

Planning your finances is essential for enjoying the benefits that come with LLCs. The right steps could turn very helpful in unfortunate events such as lawsuits. One thing you must not do is mix up your business and personal assets. Here are the important steps.

Create a Separate Business Account: When you use your personal account to manage business finances, your personal assets (like home, cars, stocks, etc.) will be at risk during lawsuits or issues with investors (if your failure to fulfill your legal obligations). To keep them safe, you need to open a separate business account as soon as your LLC is up and running.

Not to mention, this will also make the accounting and tax filings of your LLC much easier.

Get Business Credit Cards: With separate credit cards for your business, you can keep up with year-end taxes very effectively. You could also assign multiple credit cards with specific budgets to different members of your LLC. This allows you to keep track of department-wise expenses

Set up an Accountant/Accounting Software: A professional account prevents you from overpaying on taxes and avoids tax errors like penalties and fines. You also won’t have to worry about managing payrolls, leaving more time for focusing on business growth. For small LLCs, good accounting software can help calculate extra losses and profits.

2. Understand Pennsylvania Taxes

The taxation laws differ from one state to other. Pennsylvania has various types of taxes for LLCs and rules regarding their fulfillment. Here’s all you need to know.

Annual Registration – First of all, Pennsylvania LLCs don’t have to file annual tax reports. However, professional LLCs and foreign LLCs associated with professional activities must submit the Certificate of annual registration with the PA state department.

The deadline for the same is 15th April of every year, You can file it online or by mail, and costs $520 times the number of LLC members.

State Business (Income) Tax – Usually, LLCs use pass-through taxation when it comes to income taxes. In simple words, the members report their share of income on their personal tax returns. So the employees will pay instead of the LLC.

However, the members could choose their LLC to be taxed as a corporation with mutual agreement. In this case, your PA LLC will have to pay a straight 21% federal corporate.

State Employer Tax – State employer taxes are applicable if you have employees working for your LLC. This will also require your EIN (federal tax ID number). First, you’ll have to pay employee income taxes to the Department of Revenue which also requires registering the business with DOR. This can be done in person, through the mail, or online.

Usually, employer taxes have to be filed in monthly or quarterly increments. You’ll find the form on the DOS website’s online filing system.

Sales & Use Tax – If your LLC business deals with selling goods, you’ll have to collect sales tax and pay then to the state of PA. You’ll also need to register with the Department of Revenue to report sales tax and make regular tax payments. After that, you’ll get a PA sales tax license.

You need to pay sales and use taxes on monthly or quarterly bases to the DOS through their online e-tides system.

Franchise Tax – Pennsylvania state no longer requires LLCs to pay a Capital Stock/Franchise Tax.

3. Hiring Employees

When hiring employees for your Pennsylvania LLC, you must stay compliant with PA laws. Here are the things that you should make sure of.

- Make sure your new employees are able to work in the U.S.

- You’ll have to repost employees as new hires to the Pennsylvania state.

- Provide employee compensation insurance

- Print workplace compliance posters for your LLC and place them near your workplace.

We recommend: Once everything is done, the last step is to always stay in compliance with state rules and keep your LLC in good standing.

Frequently Asked Questions

1. How much does Pennsylvania charge for LLC formation?

In Pennsylvania, you'll have to submit a certificate of formation which requires a filing fee of $125.

2. How long will it take for an LLC to be approved in PA?

It takes about 7 to 14 days for Pennsylvania DOS to process an LLC. This doesn't account for the time for which your documents are in mail.

3. Do I have to file an operating agreement in Pennsylvania?

No, operating agreement is an internal document which you can keep at your business location. It's not mandatory to have it.

4. Does Pennsylvania LLCs have to file annual reports?

No, in Pennsylavania, LLCs don't have to file annual reports. But domestic & foreign LLCs related to professional services have ti file a Certificaert of Annaual registration with the DOS.

5. Is a new EIN needed for LLC if I already have one for sole proprietorship?

Yes, you'll have to get a new EIN from IRS if you're converting your sole proprietorship into an LLC.