Planning to start an LLC in Pennsylvania? The initial step that will have to take is to register the business. To do so you will have to file Pennsylvania articles of organization with the state. In this article, we will guide you through how you can start running your LLC in the state legally. Know the steps to file the document and avoid all the hassle during the process.

What are Pennsylvania Articles of Organization?

To form an LLC in the state you will have to fill and file the Pennsylvania articles of organization with the state. Every existing business in the state will get a position only when they file this document. It allows you to run a legal business in PA. As soon as you fill out the 4 main articles and file the document the SOS will verify it.

They will process the legal paperwork and only after that you will be legally able to file your business. If you want to file the document without any hassle, it is recommended to hire a registered agent. They will help you process the articles of organization with ease.

Why File Articles of Organization with PA SOS?

To benefit your business in the state and legally get a secure position among various other entities. The document acts as proof of your business’s existence in the state. You will be able to take advantage of all the benefits that government provides to all LLCs.

The benefits like perpetual existence, tax benefits, and much more. Apart from that, you will need PA articles of the organization while opening a business bank account, selling a product under legal obligations, paying taxes, and applying for a loan.

What is Included in PA Articles of Organization?

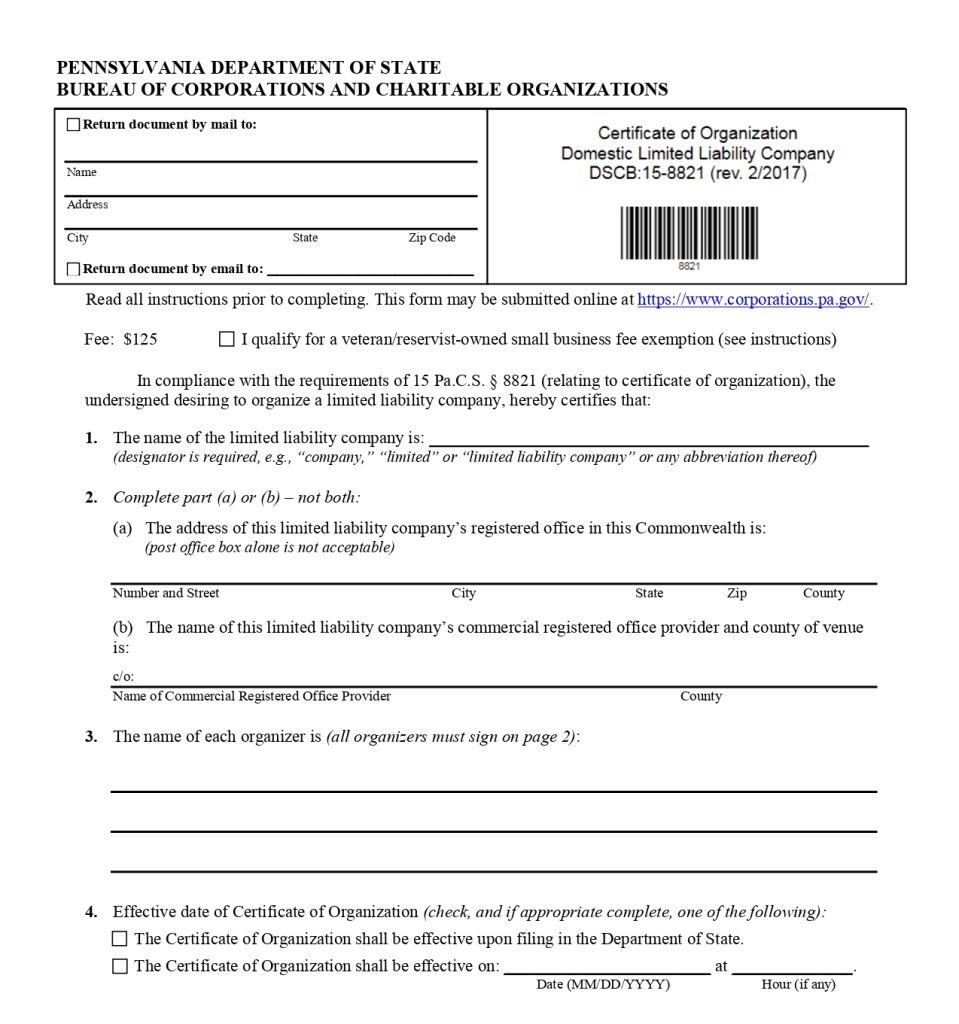

When you fill out the Pennsylvania articles of organization you will need to mandatorily provide every detail about your LLC in Pennsylvania. In the domestic LLC form, you will have to fill out the name, date, and type, as well as other company-related information.

1: Entity Name & Type

When you form a business, it is utterly important to name the Pennsylvania LLC. For doing so you must meet the naming guideline that PA has provided. Once you decide on the name for your business you must check that none of the entities in the state have the same name. You must operate your business under a unique name and check that you must check the name availability by conducting a Pennsylvania business entity search.

2: Registered Agent

A registered agent is someone who contacts the state on behalf of your LLC. They are the ones who are legally appointed and are responsible for government notices. Agents must be above 18 years and have a street address in Pennsylvania. A registered agent can be anyone from your friends or family. Even you can be your own agent. Pennsylvania registered agent is responsible for all the updates of the LLC and informs the same to the owners.

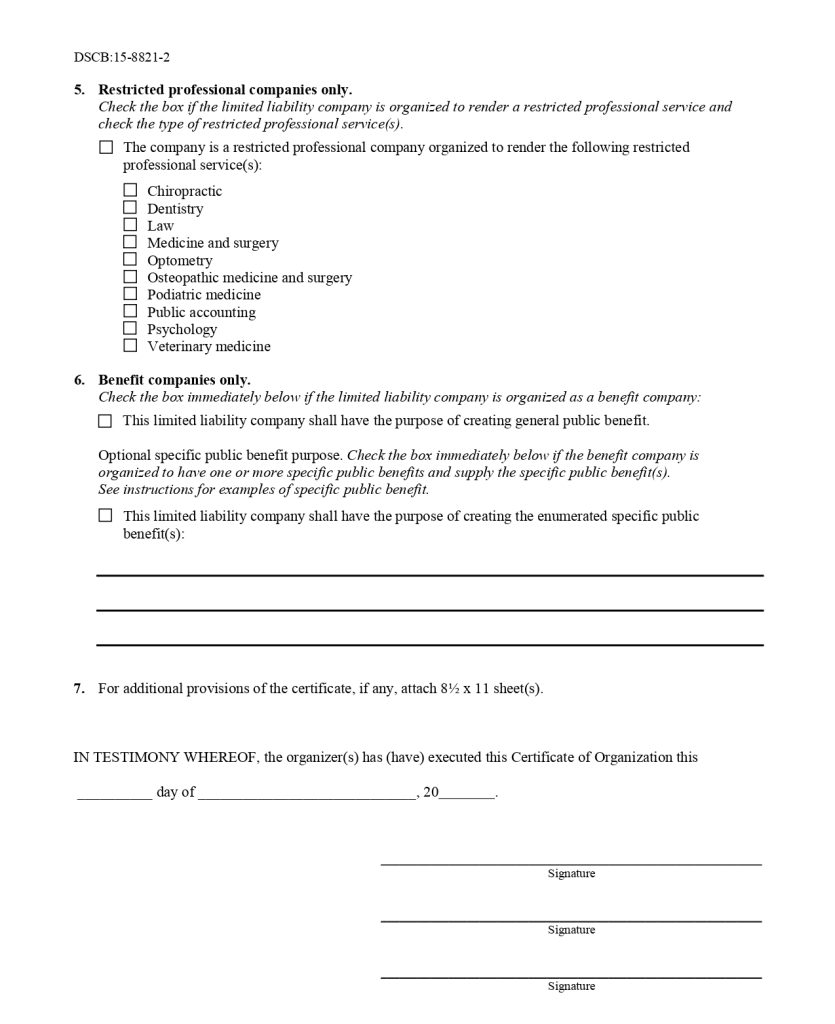

3: Organizers

All the organizers that are going to share the partnership must be enlisted. Their name and address must be added to the document. Make sure they all sign the second page of the document. It will help the state keep a record of the owners or legal authorities that are running a business in the state.

4: Effective Date

Mention the effective date from when your business will start running. You also mention the date of the future from when your LLC will start running. Make sure you mention the correct date from when the Pennsylvania articles of organization will be effective.

5: Purpose:

The most important section is purpose. You must mention which type of service is your business going to provide. The purpose of your Pennsylvania LLC must be included in the legal document. You will have to mention a clear purpose if the service your business will provide falls under any restricted services like dentistry, medicine, or the law.

6: Description of Business:

Describe the activities of your business in the legal document. All the kinds of activities your business will do should be written in the document. Make sure you do not carry out any illegal activities under your business name.

7: Employer Identification Number (EIN):

You will have to get your EIN number and provide it in the articles of organization. It is assigned to every LLC in the state by Internal Revenue Service (IRS).

The Process to File Pennsylvania Articles of Organization

It is necessary to file PA articles of organization with the secretary of state to legally run your business with the state. There are two ways that will help you file the article.

File it Online: You should follow some basic steps to file articles of organization with the state. They are:

- Create an Account

- Select PENN FILE from the dashboard

- Scroll to Manage Business Filings

- Select Domestic Limited Liability Company

- Select Certificate of Organization

- Fill out the form & tap Submit

File it Via Mail: If you do not want to fill out the form online, you always have an option to download it and then mail the document. The mailing address of the SOS is the following.

Mailing Address:

Pennsylvania Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105

Make sure you submit a hard copy of the articles of organization with a copy of the docketing statement. It is a form that is a must to submit while forming a new entity in the PA state.

Can I Amend the PA Articles of Organization?

Yes, you can certainly make changes to the Pennsylvania articles of organization. You will have to pay a $70 fee and fill out the Certificate of Amendment. Make sure you fill in all the details that you want to change in the document and file it with the Pennsylvania SOS. You can either choose to fill out the form online or download it and mail it further.

What is the Cost of PA Articles of Organization?

The charge for filing the Pennsylvania articles of organization is $125. Whereas if your business is at another location and you only have to expand it further, the cost of registering a foreign LLC with the state is $250. All the domestic LLCs in the state while forming their business have to compulsorily pay the fees of $125 to the secretary of state.

What is the Approval Time of Articles of Organization?

The total processing time that your PA articles of organization take are 7 to 10 business days. Whether you file the document online or via mail the processing timings do not vary. Whereas the approval time takes almost 4 weeks. The state will take the same time either you fill out the document online or share it via mail.

What After Filing Pennsylvania Articles of Organization?

To build a strong foundation for your company you must consider other things as well. following are the other considerations that you must know are important after filing articles of organization.

Create an operating agreement: While it is not needed by the state, we recommend you create a PA operating agreement to protect your reputation in the state & avoid future conflicts.

Get an EIN: Get an EIN that will be needed while opening a business bank account as well as while paying taxes.

Claim your business license: Get a business license on the basis of the type of business you are running in the state.

Open a bank account: You must create a separate bank account for your business to protect personal assets from business liabilities.

Frequently Asked Questions

1. How many days does a PA articles of organization takes to approve?

It takes 4 weeks for the approval of PA articles of the organization.

2. What is important to file with the hard copy of PA articles of organization?

Copy of Docketing statement is necessary to file with the hard copy of PA articles of organization.

3. Can I file articles of organization via mail in Pennsylvania?

Yes, you can mail the articles of organization via mail on: Pennsylvania Department of State Bureau of Corporation and Charitable Organization PO box 8722 Harrisburg, PA 17105

4. Can I change the PA articles of organization and the details inside it?

Yes, you can change the PA articles of organization by filing the certificate of amendment.

Remember This

To legally run your LLC in Pennsylvania, you will need Pennsylvania articles of organization. It is necessary to fill and file with the Pennsylvania SOS to get a legal identity in the state among various other entities. It will only take a week to process your application. Make sure you add the necessary information in the correct manner.