Looking to start your business in California? Forming an LLC could be the way to do it. It is very easy to start an LLC in California. You simply have to follow a few steps and you can also get help from professionals for it. Let us guide you with what to expect at every step and how to move forward with it. We will help you with how much it may cost you and how to start an LLC in California with just a few steps.

How to Start an LLC in California?

To start with, check out the complete process of how to start an LLC in California in brief. You can process your LLC formation online using the California secretary of state’s website. Whether you are looking to form a domestic LLC or a foreign LLC, you will have to use the following steps. The difference only is the paperwork that we will mention below, so let us get to it.

- California Business entity search

- Choose a registered agent

- File Articles of Organization

- File Initial statement of formation

- Create Your Operating Agreement

- Get Your EIN

Before you move on to the steps, he is an overview of California LLC which could come in handy during the formation.

| The Form | Articles of Organization |

| Agency | California secretary of state |

| Registered Agent Fee | Starting from $39 |

| Online Filing | Available |

| LLC Name Reservation Fee | $10 for mail & $20 for in-person |

| Initial Statement Formation | $20 |

Step 1 – California Business Entity Search

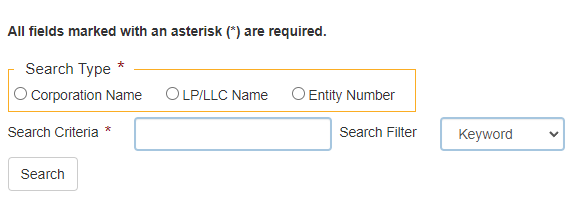

The foremost step to forming your California LLC is to find a legal name for your business. To do so, you have to go through California registered LLCs database. Using the California SOS, you can perform the California business entity search and find out which name is available. Now, another thing to note is to check whether your name is valid under the California naming guidelines. Here is what you must take care of.

- Your LLC name should end with “Limited liability company”, “L.L.C”, “LLC”, “LC”.

- The LLC name should not be such that it might be confused with a government agency.

- If you are looking to commence a bank, or an institute then you will need special licenses & permits.

- Accent marks above business name will not be recognised.

- The state will not see the upper case and lower case as distinction.

After you are sure that your name is valid and also available on the California secretary of state then you may choose to reserve your name. You can simply fill out the name reservation application online. The California secretary of state’s website currently does not allow online filing. Therefore, you can print out the application and mail them or submit it in person, both of which will cost $10 and $20 respectively.

We recommend you should select a name that is simple and matches your business offerings and values. At the same time, do not try too hard to find a unique name, it may backfire if your audience is not able to relate to it or remember it easily.

Step 2 – Choose Your Registered Agent

A registered agent can be of great help. To form your California LLC, you need information and a proper understanding of how to start an LLC in California. The filing work can be a task and hiring a California registered agent can make your work easier and you do not have to worry about missing any documents. He will carry out all the procedures while keeping you in the loop of what he is doing. He is the middle man between the company and the government. Here are some rules to be followed.

- Must be a resident of the state.

- See all the legal documents of the LLC.

- Remind on time about various renewals.

- Responsive in providing the answers.

- The registered agent is required to make the address public all the time.

Who Can be a Registered Agent?

- You can be a registered agent for your own California LLC.

- Anyone from your business can be a registered agent.

- Your family member or friends can be selected as registered agents.

- You can appoint a professional registered agent.

We recommend you choose a licensed & professional registered agent. So all your queries related to all the California LLC lawsuits will be cleared. They have experience in this field so they can easily handle different situations.

Step 3 – File Articles of Organization

A very important document to file to form an LLC in California. The article of the organization is crucial for an LLC, this will legally allow you to commence your operation. This form will include basic information about your LLC, like who is managing it, the name of your LLC, address, type of business, etc. Now you also have to note that the application for Domestic LLC and Foreign LLC is different. You can submit your file online, by mail, or in person.

Online Filing: You can fill out the form online on the California SOS and submit it. It will charge you a basic of $70 and an additional $15 for special handling.

Filing through Mail or In-person: Visit the California SOS and download the form and print it. Fill out the form and mail it or visit the SOS in person to hand it over.

- By Mail ($70): Secretary of State, Business Entities Filings, P.O. Box 944228, Sacramento, CA 94244-2280

- In-Person ($70 + $15): Secretary of State 1500 11th Street, 3rd Floor Sacramento, CA 95814

We recommend you choose the online procedure as it is a quick process and you can submit it without being in the state.

Step 4 – File Initial Statement of Information

If you have established your California LLC then within 90 days you have to file the initial statement of Information. In California, it is known as the annual report of the limited liability company. There are three options to file the initial statement of information for your California LLC such as online, by mail, & in person. Once you start filing this form you have to file it periodically every 2 years.

What is required in the statement of information?

- Accounting policies

- Cash flow statements

- Balance sheets

- Profit and loss accounts

- An overview of operations and finances

- Director’s report Auditor’s report

Mail to:

- Secretary of State, Statement of Information Unit

P.O. Box 944230

Sacramento, CA 94244

Submit In-Person:

- California Secretary of State Sacramento Office

1500 11th Street

Sacramento, CA 95814

We recommend you should file the initial statement of formation within 90 days. It is a wise decision and will help you to avoid any future legal obligations.

Step 5 – Create Your California LLC Operating Agreement

After your California LLC is formed, you can also take a look at creating your operating agreement. This is a legal document that is drawn with important and basic information about your LLC. It is not a compulsory document that the state asks you to make. Although some states do ask for it. California is not one of them. It is created internally and can be helpful to avoid any mishappening in the business. Here is what you can include in the agreement.

- Name of the LLC

- Date of filing

- Name of the members or parties

- Name of the person filing the agreement

- Address of the California LLC

- Duration of the LLC

- Fiscal year

- Name, percentage of share, and the capital contribution of each member.

- Officers and relating provisions

We recommend you create the operating agreement although it is not confined within the laws. It will only help you to run your LLC smoothly and avoid any conflicts.

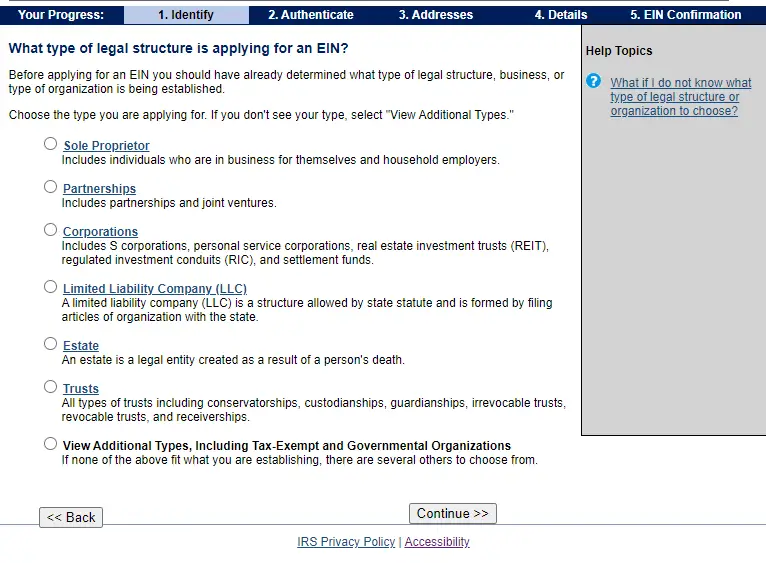

Step 6 – Get Your EIN

Employer Identification Number can be obtained once your LLC gets confirmed. EIN is a unique identification number for your California LLC that will identify your LLC for tax purposes. You can get your EIN by requesting it from the IRS. You have to visit the official website of IRS where you can get your EIN. There are various tasks for which you must have EIN. Here are some,

- If you are paying tax then it is a must.

- For hiring employees.

- To open a bank account in the name of the business.

- Perform various other financial activities.

We recommend you file the Employer Identification number for your California limited liability company. It is important and enables you to perform many operations like hiring employees and of course tax benefits as well.

California Foreign LLC Registration

You can create a foreign LLC if you have your business in any other state and you want to expand that to California. You can form your foreign LLC with a simple LLC application. Attach the required documents and pay the $70 filing fee.

Mail to:

- Secretary of State, Business Entities Filings Unit

P.O. Box 944228

Sacramento, CA 94244

How to Obtain a Certificate of Good Standing ($5)

The certificate of good standing is necessary if you are forming an LLC in California. If you want to expand your business in any other state then you have to provide a certificate of good standing. As it ensures that the formed LLC is properly maintained & legally formed. If you are finding this certificate of good standing online then you have to visit the official California secretary of state website.

- To seek funds from other lenders or any bank.

- To create a foreign LLC in any other state.

- For renewing the permits and the license.

What’s Next After Filing California LLC?

The process doesn’t end after getting confirmation for your California LLC. You should carry out various tasks for remaining in good standing with the state and running your business legally. Let us help you out with where you should put your focus next.

Set Up Your Finance & Accounting

Various finance and accounting must be settled, once you complete the formation of your California LLC. To run your business legally and smoothly you have to take the right accounting and financing steps. Having correct finance can also help you to maintain the status of your business and also helps in increasing the profits of the business.

Separate Business & Personal Expenses – If you are starting your California LLC, then you have to make sure that you are separating all the personal and business accounts. It is necessary to separate as when you form your business and mix up your assets with that, the personal assets are at the highest risk. So it would be helpful if you separate them.

Consider a Small Business Credit Card – Once you complete establishing your California LLC it would be beneficial to consider getting a business credit card for your LLC. You can get various rewards and bonuses for getting signed up for a credit card which can be factored in while zeroing down on a credit card that is suitable for your business.

Set Up Accounting Software – If you set up the right account software, it will allow you to track various receivables, what are the cash inflows and outflows of your business. You will (barely) dread tax season as a business owner with a separate business checking account and organized accounting software.

Know Your Taxes

To file taxes is important, These taxes may vary from one state to another and as per the nature of business. You should comply with the state government and pay all the taxes to remain in good standing with the state. Here are a few types of tax that you should pay.

Sales Tax – If you want to sell any product at your California LLC, then you should file/register a seller’s permit through the website of California state. It will allow you to collect sales tax on taxable sales.

Employer Taxes – In case you are hiring an employee in your LLC then you must register California employer tax. It will include employee withholding tax, Unemployment Insurance Tax, and Disability Insurance.

Federal LLC Tax Filing – Most LLCs have to file an annual report with IRS every year. The Federal tax may depend on the way you pay as an owner.

Hiring Employees

Once you complete the formation of your California LLC and if you are thinking to hire employees then you should know various things. You cannot hire anyone against the law so has a look at what should be considered while hiring

- You have to report employees as “New Hires” to the state.

- Verify whether the employee can work in the US or not.

- Worker’s compensation must be provided.

File Your Annual Report

Every California LLC has to file a biennial report, also known as the Statement of Information. You have to submit the report within the first 90 days of incorporation of business every two years. It is necessary to file it with the state to remain in good standing with the state. You have to pay $20 for each biennial statement. If you might forget to file it then California charges a $250 penalty for failure to file on time. You can either file it online or download the form, fill it and send it to the address mentioned below.

- Fee – $20 for each biennial statement (Nonrefundable)

- Due Date – Every second year by the end of the month in which your LLC was formed.

- Late Filings – California charges a $250 penalty for failure to file on time.

- By Mail – Secretary of State, Statement of Information Unit, P.O. Box 944230, Sacramento, CA 94244-2300

- In-Person – Secretary of State 1500 11th Street., 3rd Floor Sacramento, CA 95814

Frequently Asked Questions

1. In the online method, how do I provide my signature?

Yes, you have to provide your signature through digital signatures. Maybe you can upload your signature or you have to provide your signature.

2. Whats is the tax for a California LLC?

You may have to pay $800 tax if you are operating a limited liability company in California.

3. How much time does it take to register your LLC in California?

If you are going for the online method then you have to pay $750- if you want to register your LLC within 4 hours. $500 to receive it on the same day. or you can go for the $350 to receive it in 24 hours.

4. How long it takes to form a California LLC?

You will have to spend 4-5 business days if you are willing to form a California LLC. Within these days you will be able to complete all the procedures.

5. Can a member be a registered agent for the LLC?

Yes, anyone can be a registered agent, you can choose yourself as a registered agent. Or any of your members can be a registered agent.