Want to start your own New York LLC but confused about the legal requirements? Actually, it is quite simple, you just have to follow the process and guidelines set forth by the New York DOS. Discover the most important steps in this article to learn how to start an LLC in New York.

Once you read our guide you can easily understand the whole process. Here we will explain in detail each and every step along with how much it may cost you at every stage.

How to Start An LLC in New York?

In New York, whether you want to form a domestic or foreign LLC, you have to submit the article of the organization to the New York Department of State. The whole process of starting a New York LLC is divided into 6 easy steps. A visit to the New York DOS is necessary for some steps, while others can be completed online. Let’s discuss each and every step in detail.

- New York Business Entity Search

- Hire a Registered Agent

- File the New York LLC Articles of Organization

- Filing Certification of Publication

- Prepare an Operating Agreement

- Get Your EIN

| The Form | Article of Organization |

| Agency | New York Department of State |

| Filing Fee (Domestic/Foreign) | $200/$250 |

| Registered Agent Fee | Starting from $100 per year |

| Online Filing | Available |

| Certificate of Publication | Within 120 days of approval of Article of Organization |

| LLC Name Reservation Fee | $20 for 60 days |

Step 1: New York Business Entity Search

To form your New York LLC, the first thing you need is an appropriate name for the LLC. You have to select a valid and distinguishable name for your business. It must be distinct and cannot be utilized by other businesses on record with the state of New York. For that, you have to do a New York business entity search.

Search your desired name on the New York business records page to check for its availability. Another method is to submit a written request to check name availability at the Department of State. Also, the name should meet the following New York LLC naming requirements.

New York LLC Naming Guidelines:

- The phrase “Limited Liability Company” or its abbreviation words like LLC, L.L.C, Limited, Ltd, etc must be included at the end of the business name.

- Avoid using terms like FBI, State Department, Treasury, etc. as they refer to government organizations.

- Words like university, attorney, bank, etc. require an additional license in order to use them.

- Must be unique and not in use by any of the existing businesses.

- Uppercase and lowercase are the same meaning, it can’t distinguish between two names.

Name Reservation: If you have a unique name but don’t want to start a business immediately then you can reserve it with the DOS. The name reservation application costs $20 and reserves a name for 60 days.

We also recommend checking the availability of the URL and buying a domain name to make sure the same name is not taken by others.

Step: 2 Choose A Registered Agent

After completing a business entity search, the next critical step is to hire a registered agent. For New York LLCs, the department of state is the default registered agent, you just have to provide a business address. You can also hire a professional agent to receive legal correspondence on behalf of your company. They are specially qualified to understand legal filings, overcome obstacles, and accelerate the procedure.

However, there are certain state guidelines and requirements you need to follow while hiring a registered agent. To know the requirements, rules, process, and cost of an agent check out the guide to hiring New York Registered Agent.

Who Can Be My Registered Agent?

Anyone, either a person or an entity can be chosen as a registered agent. An individual should be a permanent resident and an organization should be authorized to conduct business in New York. Some of the preferred options for you are:

- New York DOS. (default)

- Can be Yourself

- Anyone from your family, friend, relatives, or employee who fulfills all the criteria.

- Hire a professional or commercial organization that is authorized to do business in New York.

We recommend, choosing a commercial or licensed registered agent who is eligible to provide the service in all states. This is because you don’t have to hire a separate registered agent while expanding your business in other states.

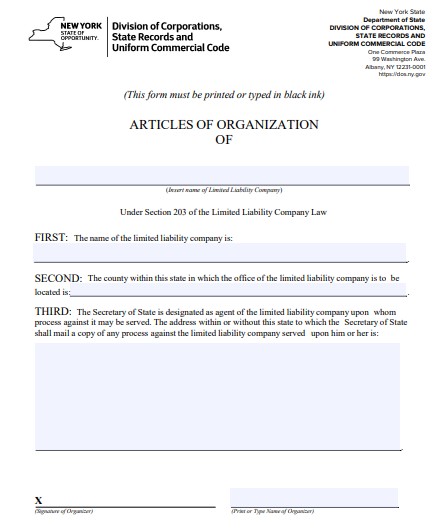

Step 3: Submit NY Articles of Organization

Now the first step of officially forming your New York LLC is filing the Articles of Organization. This is the official LLC formation document that will be public in state records. You can submit it either online, by mail, by Fax, or by visiting the NY DOS personally. For the online process, visit the NY Department of State.

For mailing and in-person you have to complete the article of organization and submit it to the address given below. The cost of filing a domestic LLC is $200 and a foreign LLC is $250.

Mailing Address:

NY Department of State,

Division of corporation and state records,

99, Washington Ave

New York

Fax: (518) 474-1418

Remember: The filler is responsible for filling up the articles of organization correctly. The state department will reject your application for any mistake. Here’s a guide on to fill up your New York articles of organization without any mistakes.

Step: 4 Filing Certification of Publication

Under New York laws, you must publish a copy of the Article of Organization or notice about the formation of an LLC within 120 days of its approval. The advertisement should be done in more than 2 authorized newspapers for six successive weeks. The publisher will then provide the affidavit of publication.

The certificate of publication along with the attached affidavit of publication should be submitted to the NY Department of State

Note: the cost of newspaper publication range from $1500 to $2000 in New York. To save this cost we suggest designating a registered agent service that might cost around $100.

Step: 5 Operating Agreement

It is the legal document that shows the ownership, rights, duties, liabilities, and operating procedures of an LLC. The main purpose of creating the New York operating agreement is to show the functioning procedure and avoid future disputes. Unlike other states, New York has made it compulsory to adopt a written operating agreement. You can draft it before or at the time of submission of an article of organization. If not, you can create it within 90 days of New York LLC registration.

An Operating Agreement contains the following information.

- Name and address of the LLC.

- Duration of the LLC.

- Details of the registered agent.

- Information about the Article of Organization.

- Members and their responsibilities.

- Name, percentage of share, and the capital contribution of each member.

- Management of the LLC.

Step 6: Get Your EIN

The Internal Revenue Service (IRS) assigns a nine-digit Social Security Number to each registered business called the Employer Identification Number. You should get your EIN number as soon as you form New York LLC because it acts as social security for your business.

What is the need for an EIN number?

- EIN is helpful to manage taxes,

- Hire employees for your LLC.

- Mandatory while Opening business bank accounts.

EIN number is mandatory to perform many business operations such as hiring employees and paying taxes. To get your EIN number for free visit the website of the IRS and submit an EIN Application.

How to Form Foreign LLC in New York?

If you already own an LLC and want to expand it to New York, then you’ll have to register as a foreign LLC. Simply fill out an Application For Authority form and attach your Certificate of Good Standing (Existence/Status). You’ll have to submit it to the NY Department of State with a $250 filing fee.

The NY DOS suggests filling this under the guidance of an attorney (or your known professionals).

Filing Address:

NY Department of States

Division of Corporation,

One Commerce Plaza,

Washington Ave, Albany,

New York

Fax: 518-474-1418

How to Obtain a Certificate of Good Standing?

A Certificate of good standing is proof that shows the status of your LLC. Therefore, it is also called a certificate of status. It guarantees that the created LLC is legally formed and maintained properly. It is mandatory to have this document when expanding and running your business in foreign states. let’s see some other benefits of having this certificate.

- Helps you to get funds from banks.

- For expanding your LLC to other states.

- Useful while renewing the license and permits.

In New York, you can get this certificate by submitting a written appeal to the NY Department of State. The request can be submitted by mail, in person, or fax to the below address.

Address:

NY Department of State,

Division of Corporations,

99 Washington Avenue, 6th Floor

Albany

Fax: (518) 473-1654.

What’s Next After Filing New York LLC?

Once the state approves your formation document, you are almost done running your business as an LLC. However, there are a few things you should consider to meet the company’s goals and run smoothly. You should focus on opening a separate bank account, getting insurance, knowing taxes, hiring employees, etc. Let’s get into each point in detail.

1. Setup Your Finance and Accounting

Separate business and personal bank accounts: Using the same account to manage your personal and business finances puts your personal possessions at risk during lawsuits. Once your LLC is ready, open a separate business account. This also makes accounting and tax filings easier.

Consider a small Business Credit Card: Nowadays most owners keep a separate business credit card. This is because, at the beginning of your business, it helps to carry an interest-free balance and boost your business credit rating.

Set up accounting software: Accounting software is now used by many firms because It saves a tonne of money and time. It maintains financial transactions and keeps track of all the cash flow. This can be extremely important both during the audit and at the end of the fiscal year.

2. Understand New York Taxes:

Understanding and filing your taxes is important. Taxes come in a variety of forms and paying them timely is crucial. Taxes vary by type of LLC and the state in which it’s registered. Sales tax, federal tax, and employer tax are the three main types of taxes.

Sales tax: You must file sales tax reports if your business involves the sale of any goods. A seller’s credentials must be recorded with the New York DOS of Taxation and Finance. Additionally, this sales tax may have various rates, including state, municipal, and district taxes. Sometimes it is also known as “sales and use tax”.

Federal tax: Federal taxes are those credited to the federal government. Every LLC in the nation is required to pay federal taxes. Moreover, the IRS might examine your yearly report. Paying timely federal taxes is crucial and it also funds the nation’s infrastructure.

Employer tax: First, you need to register for New York Employer Taxes if you hire any employee. Employer tax is also known as a payroll tax that is charged to each employee. In New York, employees have to pay about 4% to 10.90% tax based on their income.

3. Hire Suitable Employees

A new firm needs to hire suitable people to get through the initial stage (unless you’re running a small-time home business). Before hiring employees for your New York LLC, you must follow certain rules and regulations.

- Verify if new employees are able (allowed to) work in New York.

- Provide worker’s compensation insurance.

- Withhold employee taxes.

- Place workplace compliance posters near visible areas of your workplace.

4. Getting Your Business License

The prerequisites for company licenses differ by state. You’ll have to figure out if your business operations need additional licenses and permits. Different sectors need special permits such as building permits, health permits, education permits, etc.

The fees for getting a business license may vary depending on your state or what kind of license you are looking for.

5. Getting Business Insurance

The main purpose of business insurance is to focus on growing your business while also managing risks. Doing business is very risky sometimes and financial consequences can wipe out your business assets. If you have insurance your business is secured from such consequences.

General Liability Insurance: General liability insurance helps in protecting your business from claims related to property damage, personal injury, and bodily injury to others. In general, it helps to protect an LLC from lawsuits.

Professional Liability Insurance: Professional service providers such as accountants, consultants, etc. may get this insurance to cover claims such as malpractice, business errors, or mistakes in your services. Sometimes this is also called error and omission insurance (E&O). Businesses need professional liability insurance to defend themselves against allegations of carelessness.

Worker’s Compensation Insurance: Worker’s compensation insurance provides coverage for your employee. It helps in paying medical bills, funeral costs, replacing lost wages, and paying for any ongoing care. Some states have stringent laws to have worker’s compensation insurance. If not they might face criminal charges or penalties.

6. File a Biennial Report With the State

In New York, both foreign and domestic LLCs are required to submit a statement of information every two years after the formation. Its main purpose is to document the activities, financial conditions, and operations of the preceding year. The time period for filing this report is the calendar month in which LLC was formed. Before the month of the calendar, you cannot file the report.

Use the Department of State’s e-Statement Filing Service to submit the report electronically. You have to pay a $9 fee for this. Name of the entity and DOS ID number which are mandatory while filing the report can be obtained from the DOS’s business entity database. You may submit the form by mail or in person to the New York DOS. Just keep in mind that the service is only accessible Monday through Friday from 6:00 am to 7:30 pm EST.

Frequently Asked Questions

1. How much time does it normally take to form New York LLC?

It usually takes 6-7 business days for the approval of the Article of Organisation. However, it takes around 7 weeks to get a certificate that confirms the formation of an LLC from the Department of State.

2. What if I already have an LLC in other states?

You have the option to form a New York foreign LLC and expand your business in the state.

3. How does New York LLC pay tax?

If the LLC has chosen to be taxed as a pass-through all the owners distribute the tax among themselves. LLC itself does not pay tax itself; the members pay taxes depending on their income.

4. Why is it important to obtain an EIN number?

EIN is a nine-digit number that is required for opening a bank account, recruiting employees, or filing taxes.