Forming an LLC in Ohio can be much easier when you know what to do and how to form it. It is not a very long process and you can save time and make your process smoother when you file your documents and application correctly in one go. We will guide you on how to start an LLC in Ohio. Along with giving you an idea about how much it may cost at every stage of the process.

How to Start an LLC in Ohio?

To make it precise, we will simply brief you on the 5 steps that are required to legally form your Ohio LLC. You can commence your business formation online. There are two kinds of LLC formation, if you are starting a new business then you need to focus on a domestic LLC application and if you are expanding your LLC from another state then you will need a foreign LLC application. Both have the same process except for the application itself.

- Ohio Business Entity Search

- Choose your Ohio LLC Registered Agent

- File Articles of Organization

- Create your Operating Agreement

- Get your EIN

Here is an overview of Ohio LLC to have a basic understanding.

| The Form | Certificate of Incorporation |

| Agency | Ohio secretary of state |

| Filing Fee | $99 |

| Registered Agent Fee | Starting from $49 |

| Online Filing | Available |

| Franchise Tax Report Due Date | May 31st |

| LLC Name Reservation Fee | $39 |

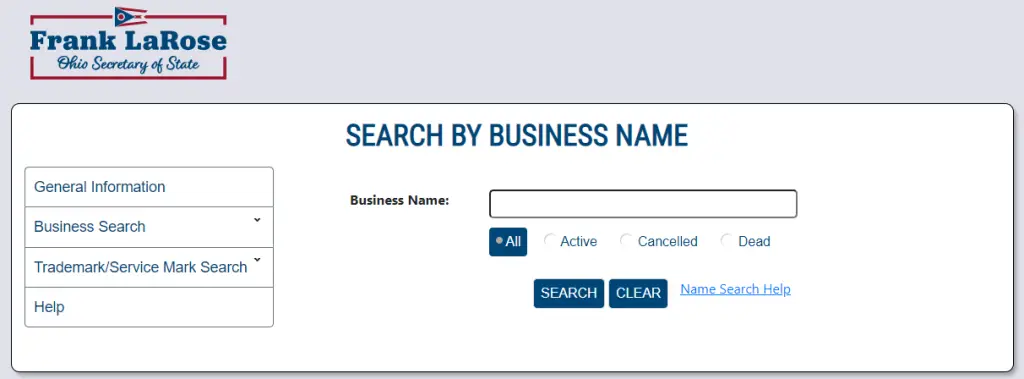

Step 1 – Ohio Business Entity Search

Choosing your business name is the foremost step of the process. This step is very easy and the state of Ohio has made this available to the public. You will need to visit the Ohio secretary of state’s website and find the Ohio business entity search tool. With this tool, you can search LLC names that are registered in the state. You can not choose a business name for your LLC that is already registered. Hence the search. You should also follow the naming guidelines before choosing the name.

- The name that you are using must include the phrase such as Limited liability company or its any abbreviation like LLC or L.L.C.

- The name you select must not include the words such as FBI, Treasury, State Department, etc as it will confuse the government agency with your agency.

- There are a few restricted words that you cannot use as it is used by the government and they can baffle the customers. For example FBI, State Department, Treasury, etc.

- You can not make a distinction between upper and smaller cases.

After your find your name, you can choose to reserve the name so that no other business can take that name. It is an optional step. Although if you choose to reserve your LLC name, you will have to fill out and print the application. You can also log in and reserve it online. It will cost you $39 and you can reserve the name for 180 days.

We recommend you choose a name that matches your business purpose and nature and is also easy for the customers to remember. Do not rush to choose the name and follow the naming guidelines.

Step 2 – Choose Your Registered Agent (Starting from $49)

A registered agent is a professional trained to file documents and form LLCs across the state. You can choose to hire a registered agent for your LLC. He or she will act as a mediator between the company and the government. You will then not have to worry about missing an important date or missing out on any filing. Here is what a registered agent should comply with.

- Whoever is a registered agent must maintain the normal business hours at the address you provided.

- You must remind the company about the notice, date, and deadline on time.

- In case you are willing to do the business from home, then you must make your address public.

- You could be served in front of your family and coworkers.

Who Can Be A Registered Agent?

Anyone can become a registered agent. You can become a registered agent for your Ohio LLC or you can choose any of your employees to act. It is also possible to choose anyone from your family member or friends. You can also get a professional registered agent to work on your behalf.

We recommend selecting a professional registered agent rather than becoming your own agent or choosing any other member of the firm. A registered agent is a trained professional and so he or she will have a better understanding.

Step 3 – File Articles of Incorporation ($99)

To legally form your LLC in Ohio, you will need to file the articles of incorporation. The application would be different for both Domestic LLC and Foreign LLC. You can choose to file it online on the Ohio secretary of state website or fill out the application for Domestic LLC and Foreign LLC and then mail it to them. The cost for filing this application would be $99. You can pay $100 extra if you want 2-Day Expedited. Here is the address:

Mail to:

- Ohio Secretary of State

P.O. Box 670

Columbus, OH 43216

Expedited Filings:

- Ohio Secretary of State

P.O. Box 1390

Columbus, OH 43216

We recommend you to select the online filing and in case of any emergency, expedited filing could be helpful as well. Online filing is also proved to be faster and smoother.

Step 4 – Create Your Operating Agreement

Once you complete creating your Ohio LLC, you have to get your operating agreement. Ohio operating agreement is an internal document that is used for the internal affairs of the business. It reduces the number of conflicts or misunderstanding that occurs in your firm. In this agreement, you will find information like

- Name of your LLC

- The principal address of business (if different from the statutory agent)

- Name & Street address of the statutory agent

- Name and address of the manager or each member of your LLC.

- Management of LLC (whether by the member or by a manager)

We recommend getting your operating agreement though not made compulsory by many states. If you will have your Ohio LLC Operating agreement then it may solve many conflicts that might take place in your business.

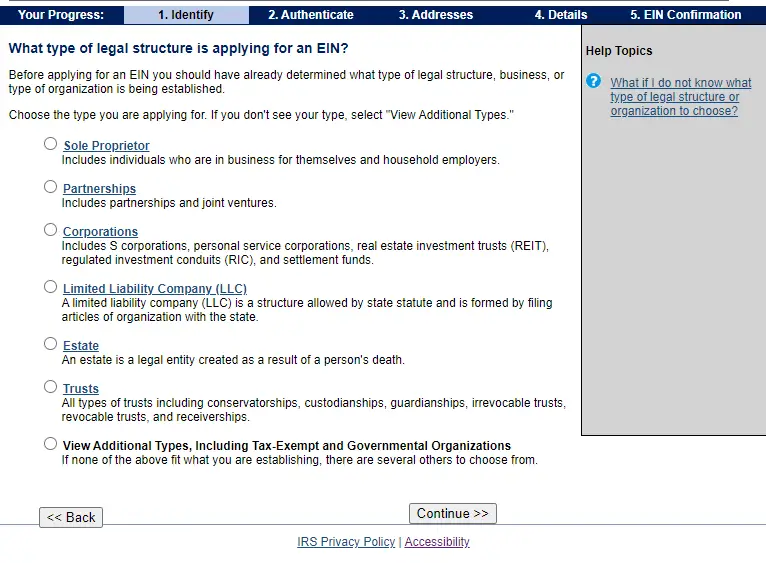

Step 5 – Get Your EIN

It is important to get your EIN as soon as your LLC in Ohio is created. EIN is necessary to hire employees, open bank accounts, and file taxes. This number will be provided by the IRS, and they will use this number or track you as a tax-paying entity.

How EIN can help?

- You will be able to open a business bank account.

- It allows you to hire employees.

- It will help you to file and manage federal & state taxes.

- EIN will allow you to perform financial activities.

We recommend you get your EIN as soon as you complete forming your Ohio LLC. It is also recommended to file it online so that you can get your EIN as soon as possible.

Ohio Foreign LLC Registration

If you are looking to expand your business in Ohio, you will be required to form a foreign LLC. You can apply for the same through the Ohio secretary of state’s website. The filing fee would be $99 for standard filing and $199 for expedited filing (2 days filing process). Also remember, you will need to obtain a certificate of good standing while filing for a foreign LLC.

Mail to:

- Ohio Secretary of State

P.O. Box 670

Columbus, OH 43216

Expedited Filings:

- Ohio Secretary of State

P.O. Box 1390

Columbus, OH 43216

How to Obtain a Certificate of Good Standing? ($5/$25)

The certificate of good standing to prove that your LLC is legally and properly maintained. You will get a certificate of good standing from the state where your business was formed. You must look to it that are filing all the taxes on time and have all the permits. Here are some of the instances where you will require to have a certificate of good standing. You have to pay $5 Normal; $25 Long-Form for getting it.

- To seek funds from banks & other lenders

- To renew or get any license or permits for your LLC

- It is required at the time of creating a foreign LLC in any other state.

What’s Next After Filing Ohio LLC?

As soon as you complete forming your LLC, you should have a look at some of the things that you should do after forming an Ohio LLC. To remain compliant with the state, you should file all the things mentioned by the government. You should pay the taxes, licenses, and permits to remain in good standing with the state. Let us take a look at a few decisions a business should make after its formation.

Set Up Your Finance & Accounting

There are 3 things that you should look for while setting up your finance and accounting.

Separate Business & Personal Expenses – There are many expenses that you should perform to keep your LLC working. If you mix up your personal and business expense, that may create various troubles and conflicts. So, once you form your LLC try to separate your personal and business expenses as well as the assets.

Consider a Small Business Credit Card – It is known to be smart to have a credit card for your LLC, once you complete the formation. Which card is good and which is not may be the question by most people. So, consider that a small card can be a good option for you.

Set Up Accounting Software – If you are willing to track your receivables correctly, then selecting the right accounting software is the most important thing. It will also help you to track the money inflow and outflow of your business. So, having perfect accounting software can help your LLC to achieve success and get profit.

Know Your Taxes

Knowing your taxes is equally important. The business will have to pay different kinds of taxes and here are a few you should know about.

- Sales tax – If you are a seller & selling certain products to consumers then you must get a seller’s permit. You can visit the Ohio Business Gateway website to acquire this permit.

- Employer tax – If you have hired employees or you have a worker in your Ohio LLC then you must register unemployment insurance tax on the Ohio Department of Job and Family Services.

- Federal requirements – If you have successfully registered the Ohio LLC then you also have to report the income to the Internal Revenue Services IRS every year. You must complete this process by completing the form,

- Form 1065 Partnership Return (most multi-member LLCs use this form)

- Form 1040 Schedule C (most single-member LLCs use this form)

Hiring Employees

Do you know that you cannot select just anyone as your employee? You must know the rules that you should comply with while hiring employees for your LLC. It is easy to remember and not much of a hassle.

- Verify whether the employee can work in the US or not.

- Worker’s compensation must be provided.

- You have to report employees as “New Hires” to the state.

Note: Business entities are not required to file an annual report with the Ohio secretary of state.

Frequently Asked Questions

1. How much does it cost to start an LLC in Ohio?

If you are willing to start an LLC in Ohio then you will have to submit a few documents including $99 registration fees.

2. Can I be my own statutory agent?

Yes. You or anyone else in your company can serve as the statutory agent for your Ohio LLC.

3. How many days does it take to form the Ohio LLC?

Filing articles of organization will take 7 business days but the processing may take time depending upon the number of filing.

4. Is filing an operating agreement a compulsion in Ohio?

No. It is not a legal requirement but it is recommended to create your operating agreement for future reference.

5. Do I need an EIN for my LLC?

All LLCs with employees, or any LLC with more than one member, must have an EIN. This is required by the IRS.