An LLC is the best option if you want to officially form your business in the state of Virginia. Doing so is very simple but you need to follow certain guidelines to successfully register your Virginia LLC. Thus, here’s your simple guide on how to start an LLC in Virginia.

How to Start an LLC in Virginia?

When you plan to start a Virginia LLC in the state you must know the 5 steps process. You need to file the LLC with the state but before that, there are some other procedures as well that you have to follow. You will have to also file the documents with the fees that the state offers.

It can either be done online or via mail. All the filings should be carried out according to the state rules. The five steps that are needed to start an LLC in Virginia are as follows.

- Virginia Business LLC Search

- Appoint a Registered Agent

- File a Virginia LLC Articles of Organization

- Create a Virginia LLC Operating Agreement

- Get an EIN for your LLC

Before you go through these steps in detail, check the following table which will brief you a bit on what is the cost of forming an LLC in Virginia.

| The Form | Articles of Organization |

| Agency | Virginia State Corporation Commission |

| Filing Fee (Domestic/Foreign) | $100 |

| Registered Agent Fee | Starting from $49 per year |

| Online Filing | Available |

| Franchise Tax Report Due Date | May 1st |

| LLC Name Reservation Fee | $10 |

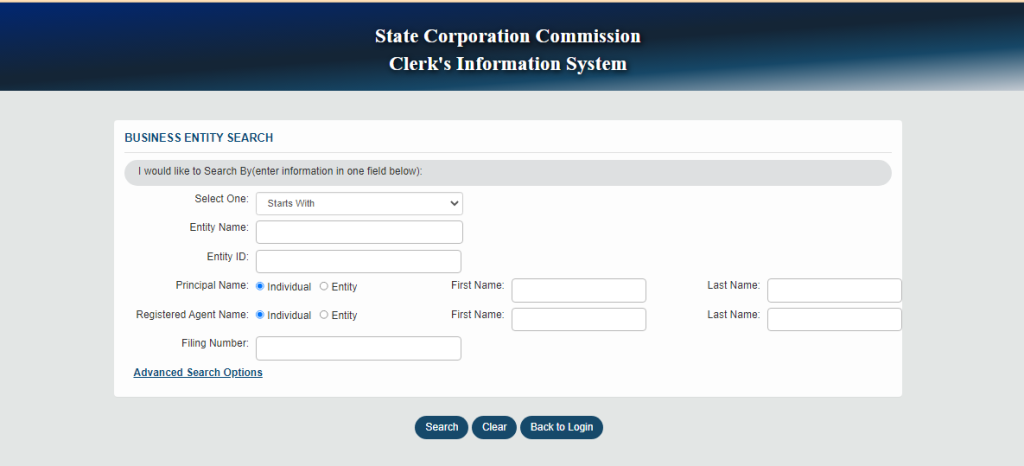

Step 1: Virginia Business Entity Search

The initial step after planning to start your business in the state is to name your LLC. To do so you will have to check the name availability. Make sure you have a few names handy to check the name availability. Here is our guide on how to perform the Virginia business entity search. Also remember, that your name should follow some specific rules.

Virginia LLC Naming Guidelines

- At the end of the name of your business, you must include Limited Liability Company or its abbreviations like LLC or L.L.C

- Do not implicate your business name as a government agency in the state by adding the words like FBI, treasury, or state department

- If you are willing to use words like an attorney, bank, university, etc., then you must have a legal license that is valid in the state of Virginia

- There is no distinction in the name of your business between uppercase alphabets and lowercase ones

If you are not looking to form your LLC immediately, you can also choose to reserve the name. You will need to pay a $10 fee to the SOS and reserve it for 120 days. If you want to extend the period you can file the same application and pay the same fees.

We recommend you choose a unique name that represents the nature and service of your business. This will help you to easily get a domain name and also ease your customer to remember the name.

2: Appoint a Registered Agent [Starting from $49]

Once you successfully decide on the name of your LLC in Virginia you can take a step forward by appointing a registered agent. They are trained professionals who are responsible for all the legal notices and important business documents. Agents are the ones who help you move the legal processes further.

Who can be a Registered Agent for Virginia LLC?

Appointing a registered agent will make ease the whole process of forming your LLC in Virginia. You can appoint anyone from the company or from your family or even yourself to be an agent. You can also hire a professional individual to be your registered agent. Here is our guide on Virginia registered agent for a better understanding. There are certain necessities that you must follow while hiring your registered agent.

- The age of the registered agent must be 18+

- Your agent should be a resident of the state.

- They must have a Virginia street address that can be filed publically.

- There are no restrictions on hiring a registered agent as long as they are worthy enough to take all the responsibilities of the business

We recommend you appoint a registered agent who is professionally trained while starting your LLC in Virginia. You can be your own registered agent but it is recommended to hire a professional only.

3: File Virginia LLC Articles of Organization [$100]

After appointing a suitable candidate as a registered agent for your business, it’s time you register your LLC with the state. To file your company with the Virginia State Corporation Commission you will have to file Virginia LLC articles of organization. The document when approved will help your business to secure a legal LLC in the state. Every entity in Virginia has to mandatorily file its existence with the Virginia secretary of state.

It will cost you a $100 fee whether you file a domestic LLC or a foreign LLC. The fees that you pay to the State Corporate Commission for the document are non-refundable. You can file the legal document online or mail it to the given SCC address.

- Mail Address:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

We recommend you file the Virginia LLC articles of organization online as it’s easier than mailing the form to the SCC office.

4: Create Virginia LLC Operating Agreement

To run the operations of a company, a legal document is mandatory. You must draft an operating agreement for your LLC in Virginia. It will help you keep track of all the changes in the company as well as be helpful for future references.

You do not have to file an operating agreement with the state but drafting one is crucial. But it highlights details related to ownership, profit distributions, positions, and responsibilities of members. This way you may prevent future conflicts among your LLC members.

We recommend you file all the copies of an operating agreement in your business records that will be helpful for future references.

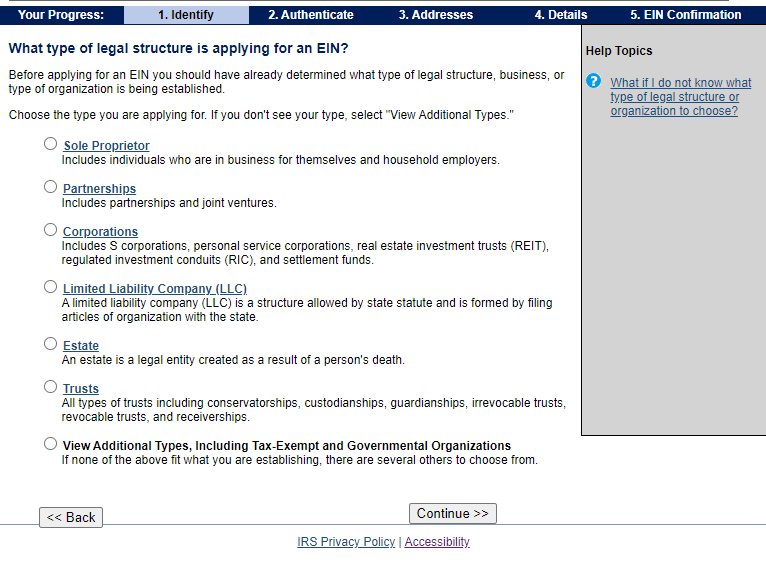

5: Get an EIN for Your LLC in Virginia

EIN means Employer Identification Number that is a necessary part of any entity in the state. The number is given to every business in the state of Virginia by Internal Revenue Service (IRS). It is important to hire employees, and open a business bank account, as well as it is considered a legal requirement.

To get an EIN for your Virginia LLC you will have to visit the official website of IRS. Once you open the website on the screen you will have to fill out the SS-4 form.

Why does an LLC Need an EIN?

- The LLC will need an EIN in case of opening a bank account under its name

- Helpful for your IRS to track the taxes of your LLC

- To hire employees for your company

- Considered as a tax-paying LLC in the state by IRS

We recommend you get your EIN as soon as you confirm your LLC in the state. It will support you to perform all the financial activities in the state.

Virginia Foreign LLC Registration [$100]

If in case, you have your LLC registered in another state but you want to operate and expand your business you will have to register your LLC as a foreign LLC. It allows you to operate your business in multiple states as one entity. You have to do this procedure only via mail and by paying a $100 fee to the State Corporate Corporation. Download form LLC1052 from the official website of Virginia SCC to register your foreign LLC.

Mailing Address:

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218

Note: The fees that you pay while registering your LLC as a foreign LLC are non-refundable. Make sure to mail the form to the correct address and pay the accurate fees.

Obtain a Certificate of Good Standing [$6]

A certificate of good standing is important if you wish to operate your business in another state. In Virginia, the certificate of good standing is also known as the Certificate of Fact of Existence. It is proof that your Virginia LLC is legally formed under all regulations of the state as well as maintained well. There are certain instances where you will need the certificate which are as follows:

- In any case, if you are looking out for funds from a bank or other official lenders

- To form a foreign LLC and expand your business in other states.

- Claiming certain business licenses and permits

- Also, while renewing legal documents, licenses, and permits

Note: You can request the Certificate of Fact of Existence online by paying $6 which is non-refundable.

What’s Next After Filing VA LLC?

To form a successful LLC, the steps do not end here. There are other considerations as well that you must know while forming a Virginia LLC. Do the following things to secure your newly formed Virginia LLC.

Set Up Your Finances & Account

The first step after forming your LLC in Virginia is to set up your finances. Make sure you have clear accounts by thoroughly going through the base that is by checking the cash flow and revenue. It plays the most important role and you must know how the cash flows and where is it used. You must keep track of money and consider doing the following:

Separate Your Personal Expenses: Keep your personal assets separate from your business. It will reduce the risks in the future for both your LLC and your personal expenses. Form a separate business account and a personal account which can help save your personal assets. You will be able to cash flow more effectively by separating the accounts.

Claim a Small Business Credit Card: Once you legally establish your company in the state, you must consider getting a business credit card. You can choose the one which has factors like 0% APR that helps your LLC run on an interest-free balance.

- Differentiating the business expenses and categorizing for taxes that an LLC has to pay at the end of the year

- Maintaining your business credit score which in turn helps in the future if you are seeking to get a business loan

- Print out multiple cards from various departments through which you can keep a track of their expenses.

Set Up Accounting Software: To keep a track of the cash flow of your business you need to find suitable accounting software. You can even track the account receivables and it simplifies the tax burden that you have to pay every year.

Know Your Taxes

There are different types of taxes. Depending on the type of your business you must know which taxes are mandatory that you must pay. In general, an LLC has to comply with three types of taxes, federal tax, sales tax, and employer tax.

Sales Tax: If your LLC is selling any product under its name then you will need to pay sales tax. You will need to file a seller’s permit through Virginia State Tax Department. On all taxable goods, this certificate will allow the collection of sales tax.

Employers Tax: On the Virginia tax website you will have to register Unemployment Insurance Tax as well as Employee Withholding Tax if you have an employer from Virginia.

Federal Tax: Every LLC in the state has to report its income with the IRS every year. How you pay as an owner affects the federal tax. There are different forms for different types of LLCs.

Appoint Suitable Employees

You must know that you hire a suitable candidate for the type of business you will carry out. Employees must be responsible enough and as they are the base of the LLC you must choose the right candidate. There are certain rules that you must know while hiring an employee for your Virginia LLC.

- Employees should be able to work in the United States with their own consent.

- Report the employee that you hire for your company as a “New Hire” to the state

- Ensure you provide compensation to every employee that you appoint to work in your LLC

File an Annual Report

You have to mandatorily file the annual report of your LLC with the State Corporation Commission. It contains all the details of the changes that took place in your LLC throughout the year. You can only file this report online by paying $50 fees to the SCC and the fees are non-refundable. You must file the report on time and before the due date.

Due Date: The due date for filing the annual report is the last date of the month that you registered the LLC in the state of Virginia. Make sure you do not delay the filings otherwise you will have to pay the extra fees for late filings.

Late Filings: If in any case, you miss the date of filing the annual report with the State Corporation Commission then you will be charged an extra fee of $25. The state will wait for three months for you to file the report. After three months they will dissolve your Virginia LLC for failure to pay your annual report registration.

Frequently Asked Questions

$50 is the annual registration fee for Virginia LLC.

LLCs in Virginia have to pay taxes annually with Internal Revenue Service (IRS).

To file articles of organization in Virginia you will have to pay a fee of $100.

Every LLC in the state will need a certificate of good standing while seeking out a business loan or even while opening a bank account.

The last date of the month in which the LLC was formed is the due date of filing the annual report every year. 1. What is the annual registration fee for Virginia LLC?

2. With whom does LLCs in Virginia have to pay taxes?

3. How much does it cost to file articles of organization in Virginia?

4. Why do an LLC need certificate of good standing?

5. What is the due date of filing Virginia annual report?