Thinking of establishing your own liability company in Virginia? It’s quite easy you just have to file the Virginia articles of organization to the state department. It is the official proof that allows you to run the business legally as an LLC. But before filing, be aware of the terms, needs, process, and cost of submitting this document. Our guide will help you to understand all the details processes and register your business.

What are The Virginia Articles of Organization?

Virginia articles of organization is the legal form you need to fill out and submit to the Virginia State Corporation Commission to register your limited liability company. Filing this document is necessary for every business that wants to operate as a legal LLC in Virginia. It acts as legal proof of the existence of the company, and you get various government tax benefits. It also assists in opening a business bank account, getting funds, etc.

What Information Do The Virginia Articles of Organization Contain?

There are mainly 6 sections that need to fill out in Virginia articles of organization. You have to give the name of your business, details of the registered agent, registered office address, and principal office address to fill these 6 sections. Let’s discuss in detail what you are supposed to do in each article.

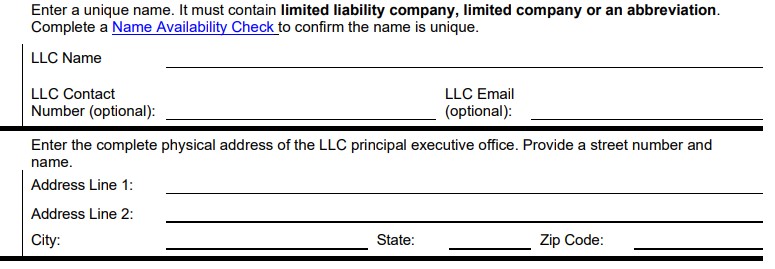

Article 1: LLC Information

The first thing you need to fill up is the name of the company. The name must be distinguishable from the existing names of businesses in Virginia and also follow the Virginia business naming guidelines. To find a unique and non-existing name, you need to do a Virginia business entity search. Also, keep in mind the following naming guidelines.

- Your name in the form should end with Limited company, Limited liability company, L.C., LC, L.L.C., or LLC.

- You need to have permission or approval to use words like an engineer, architecture, lawyer, etc.

- Avoid using words that confuse your business with government departments (Virginia Police, FBI, etc.).

- Don’t use other business structures like LLP, or corporation in your name.

Article 2: Principal Office Address

Here you have to mention the complete address where your Limited Liability company is located. P.O Box is not accepted so you have to give your street address only. It is the executive office where the company would keep the list of its members as well as other internal corporate records.

Article 3: Name And Qualification of Registered Agent

Here you need to provide the name of the Virginia registered agent you hired for your company. If you don’t have an agent till now, you need to find one first. A registered agent is responsible to receive the legal papers on behalf of your firm and provide timely reminders about legal paperwork.

The good thing is that a registered agent can be any individual from family, friend, company, or relatives who is a permanent resident of Virginia. You can also appoint a professional/commercial organization as an agent for better reliability. The fees for a professional agent may range from $49 to $300 per year.

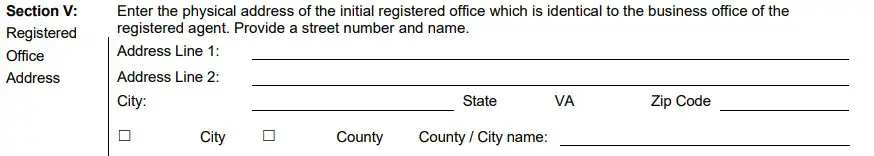

Article 4: Registered Office Address

Give the accurate physical address of the registered agent. This is the address where the secretary of state will ship all the legal documents via mail. The physical location needs to be within Virginia. Mailing address, virtual address, and P.O Box are not acceptable.

Article 5: Organizers

In the end, there is a section where you need to note down the list of the organizers. If the entity is the organizer, the name and title of the individual signing the document are also required. All the organizers have to sign in this section.

How to File Virginia Articles of Organization?

Once you have completely filled out the form and rechecked the information mentioned, you need to submit it to the Virginia State Corporation Commission. The company is officially formed once the document is approved. The filing can be done by two methods: online and offline.

1. Online process

Login to your account with Virginia SCC and go to “New Business Formations.” Select “form Limited Liability Company” and fill in the required information. Read the terms and conditions properly and submit it. You may also fill out and upload the pdf form of this document.

2. Offline process

Another option is to download the pdf form of Virginia articles of organization, fill it and submit it through the mail or in-person to the following addresses. The processing and approval may take some time with this method.

Mailing address:

Virginia State Corporation Commission

Office of the Clerk

P.O. Box 1197

Richmond, Virginia

Physical Address:

Virginia SCC

Office of the Clerk

1300 E. Main Street

Richmond, Virginia

Can I Amend The Virginia Articles of Organization?

Yes, you can amend your Virginia articles of organization at any time. You may change any information as long as it’s approved by the members. You have to fill out and submit the articles of amendment. The fee for filing this form is $25.

Note: The article of correction is different from the article of amendment. It is used to make changes only.

What is The Approval Time For VA Articles of Organization?

The approval time depends on the method used to submit the document. Online submission can be approved within 2-3 business days. At the same time, it might take up to 14 days if the submission was done by mail or in person. However, if you want it to be approved faster you can pay for expedited processing.

How Much Does Virginia Articles of Organization Cost?

You have to pay the filing fee of $100 at the same time you submit the Virginia article of organization. The form further proceeds with the filing process only after making the necessary payment. You may also need to pay for expedited services if you want the process to be faster. The expedited fee for the same day is $200 and $100 for the next day.

What After Filing Virginia Articles of Organization?

After the approval from the state department, your company can legally operate as an LLC. However, there are still many things you should take into consideration to run your business smoothly and reach your goals.

After completing registration you should focus on creating the Virginia operating agreement to establish the management and structural overview of the company. It helps to operate the company smoothly and avoid any future conflicts between members. Open a separate bank account to secure personal assets. Get the Ein number to hire employees and pay taxes. Also, get insurance to cover damages and legal claims against their company.

Frequently Asked Questions

1. Is it mandatory to open a separate business bank account?

Creating a separate business bank account is crucial but not mandatory. A separate account will help you to keep your personal assets secured.

2. How to get the EIN number for my Virginia LLC?

You can get the EIN number for free from Internal Revenue Service. Visit the IRS website and submit the form SS-4.

3. How does Virginia LLC pay taxes?

In Virginia, the LLC is subjected to pass-through taxation. This means the LLC won't pay taxes but distribute among the owners.

4. Is it compulsory to draft an operating agreement?

The operating agreement is the document that shows the ownership, management, and structural overview of the company. It is not mandatory to draft the operation however, most states suggest it keep one.

Conclusion

It is very important to fill out the correct information before submitting the Virginia articles of organization. Any mistake with the name or office address may result in the rejection and paying for filing fees again. We suggest reading our complete guide on how to start an LLC in Virginia for a better overall understanding.