Want to start your business in Texas? you would need to file the Texas certificate of formation. This is an official document that legally lets you run your business in the state of Texas. We will guide you through how you must file the certificate of formation and other considerations that will make your process smoother and avoid any hassle during and after the process.

What is a Texas Certificate of Formation?

This is a legal document that is required to be filled to run an LLC in Texas. Every business must file the Texas certificate of formation with the Texas secretary of state. There are 4 main articles in this document which are mandatory to be filled. You are also recommended to hire a registered agent from Texas to help you professionally complete the filing without any hassles.

Why File a Certificate of Formation with the TX SOS?

When you file a Texas certificate of formation with the secretary of state, you will be benefited from it in several ways. The foremost benefit is that it acts as legal proof of your business existence and with it, you also enjoy other government benefits offered to all LLCs. These can include tax benefits, perpetual existence, and more. You will also need this certificate to open a company’s bank account, issue shares, apply for a loan or even sell a company under legal obligations.

What Information is Needed in the Certificate of Formation?

There are 4 articles in this form 205 certificate of formation and you will need to mandatorily fill all of them to legally register your LLC in Texas. Here is what you need to do under the 4 articles.

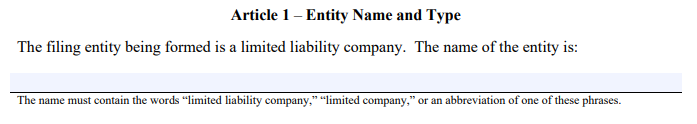

Article 1: Entity Name and Type

The foremost thing to fill is your Texas LLC name. You must have thought of your LLC name by now, if not you must think of a name first. The name should follow a set of guidelines and you should also run it by the name search tool. You can use our guide on how to use the Texas business entity search. Only then will your name be legal and valid with the secretary of state.

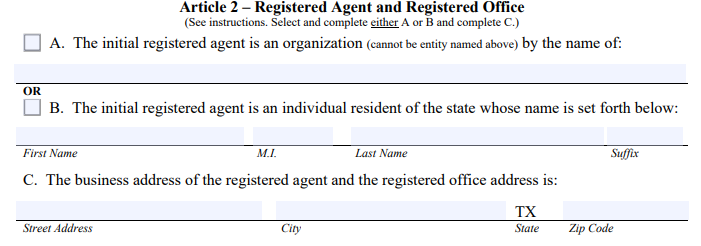

Article 2: Registered Agent

The 2nd Article of your Texas certificate of formation requires the details of your registered agent. This will officially register your Texas agent. Your registered agent must have a mailing address in Texas and should be above the age of 18. As shown in the image below, you can either fill “A” or “B.” Fill A if the registered agent is hired from an organization. Fill B if the registered agent is an individual resident.

Article 3: Governing Authority

The 3rd portion of this document will be about the governing authority of your LLC. State whether your LLC is member-managed or manager-managed. It is recommended to have a member-managed structure when your LLC is small and every member is willing to help you out with the day-to-day operation. In the case of a large size LLC, you must go for a manager-managed structure.

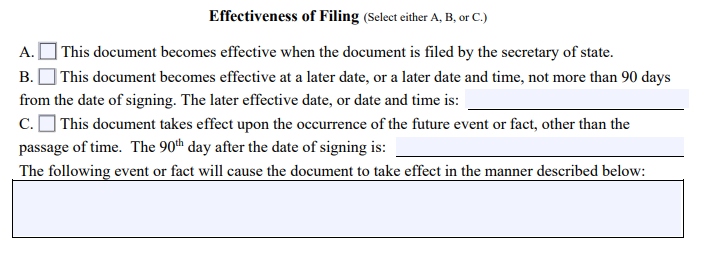

Article 4: Purpose

You must state the purpose of your LLC next. You must also state the mailing address where you want the official mails from the government. Then under the “Supplemental Provisions/Information” section, you must type in or write the purpose of your LLC. Next, state the name and address of the organizer. After which you will have to tick either of the three options under the section “Effectiveness of filing.” Lastly, sign the declaration.

How To File My Texas Certificate of Formation?

To register your Texas LLC, you must file your formation certificate with the Texas SOS. There are two simple ways to do this. You can choose to fill the file online or print the document and submit it in person or mail the SOS. The filing fee for this document is $300.

File Online: You can file your Texas certificate of organization online on the SOS website. You will have to create an account first and then start the process of filing as explained above.

File it by mail: Another option would be to download the file, fill it out, and mail it to the secretary of state. You can mail them to this address.

Mailing Address:

Secretary of State

P.O. Box 13697

Austin, TX 78711

Can I Amend the Texas Certificate of Formation?

Yes, all the LLCs must keep their information updated in the certificate of formation. Therefore, if there are any changes after you file your formation, then you must change them. You can make any changes using form 424 of Texas SOS. The form will look similar and you can change the details online or by sending a mail to SOS. This whole process will take $150.

How Much Does TX Certificate of Formation Cost?

It will cost you $300 to file the Texas certificate of formation with the secretary of state. In addition, another 2.7% convenience fee from the state. On the other hand, if your business is 100% owned by veterans, then this filing cost will be waived off. This cost is solely for filing this particular application and others before and after it.

What is the Approval Time For The Certificate of Formation?

The approval time may differ depending on how you are submitting your application to the state. If you are filing and submitting the application online then the state will approve it within 10-15 business days. In case you have mailed the application to the state it may take 12-14 business days. Now, if you are filing a non-expedited form then the state may take 70-72 business days.

What After My Texas Filing Process?

After your Texas certificate of formation is filed with the SOS, the process does not end there. You must build a strong foundation for your LLC and also consider things that are required to run the LLC smoothly. Here are the next few things you should consider doing.

Create an operating agreement: It is not mandatory to file an operating agreement with the state. Although it is recommended because it can be helpful in many future discussions or conflicts. Know more about the details you must include before drafting your Texas operating agreement.

Get your EIN: Employer identification number can be issued from the internal revenue services (IRS). This can be issued for free from the IRS. You can choose to file it online or by mail. You will only need to file an application. Know more about the EIN on the IRS website if you are looking to hire any employees.

Get your business license: There might be a requirement for a business license depending on the type of business you are running. Therefore you must contact the government office to enquire about any necessary license to smoothly run your business.

Open a Bank Account: You must have a separate bank account for your business. You would not want to mix your personal account because that would lead to your personal asset being at risk. Therefore create a business bank account and keep it separate.

Frequently Asked Questions

1. Will filing a certificate of formation keep others from using my company name?

If your business name is in the SOS records then other businesses will be prevented from taking your business name.

2. Can I add terms like University/School in my LLC name?

Yes, you can but you must have a prior approval from the Texas Higher Education Coordinating Board. For this approval you must send them an application for the same.

3. How long will it take to process the certificate of formation?

It may take around 5-7 business days for the secretary of state to process your application.

4. Will I need to file an annual report every year?

No, In fact in Texas, you will not need to file an annual report at all. Instead you will be required to file franchise tax report.

Remember This

You will need the Texas certificate of formation to run your LLC in Texas. So do file it properly and for that reason, it is also recommended to use a professional registered agent who can help you through this process without any mistakes or issues. It should not take more than a week to process your application.