It is often the case that a business is not using its legal name to run its business. They use an assumed name. For example, an owner named Lily opened her own LLC in Texas in the name of “Lily’s food services L.L.C.” She might get an assumed name or a Texas DBA in the name of “Lily’s Catering” So why do businesses do this? and if you are looking to understand how to get a DBA in Texas then here is what you need to know.

What Does A Texas DBA Mean?

DBA stands for “Doing Business as” this is not your legal name. Although if you do not have an LLC or Corporation in Texas, forming a Texas fictitious business name will mean that you are a sole proprietor. Generally, DBA is formed when a brand wants to run a business under a different name or maybe to expand its business into other industries. A good example would be the company Gap. The legal name of this brand is “Gap Inc.” but it is using several DBAs like The Old Navy, Banana Republic, Athleta, etc.

Do I Need A DBA in Texas?

To form a Texas DBA is not mandatory but many companies run their business under a Texas fictitious business name. As explained in the example above, running a business using a DBA is much easier. There might be many reasons for it like, your legal name is not appropriate anymore, maybe you are looking to expand into a new business, etc.

Now, If you have a registered Texas LLC or a Corporation, you would need to file a Texas assumed name certificate with the Texas secretary of state. If you are a sole proprietor or in a partnership, you would need to file the Texas assumed name certificate with the county where you conduct your business.

What to Consider While Filing a DBA?

If you are looking to know how to get a DBA in Texas, you must consider the following points to ensure there is no hassle in the process and to also avoid rejection from the government.

- You can not falsely claim to be an LLC or a Corporation.

- The DBA name should be unique and not in the record of the Texas SOS.

- Your LLC or Corporation must be in good standing with the state.

- Not all states accept credit cards so you might also keep a money order or cheque ready.

- Mention the period for your DBA, you will need to renew it once it expires.

- You can not operate under an assumed name even if you have a registered LLC.

How Can I File a DBA in Texas?

To legally run a Texas fictitious business name, you must register your business. You will need to file the Texas assumed name certificate. Although, before that, you will need to make sure where exactly you have to file your DBA and how to get a DBA in Texas. It can either be at the county clerk or the secretary of state. After which you can focus on the following steps:

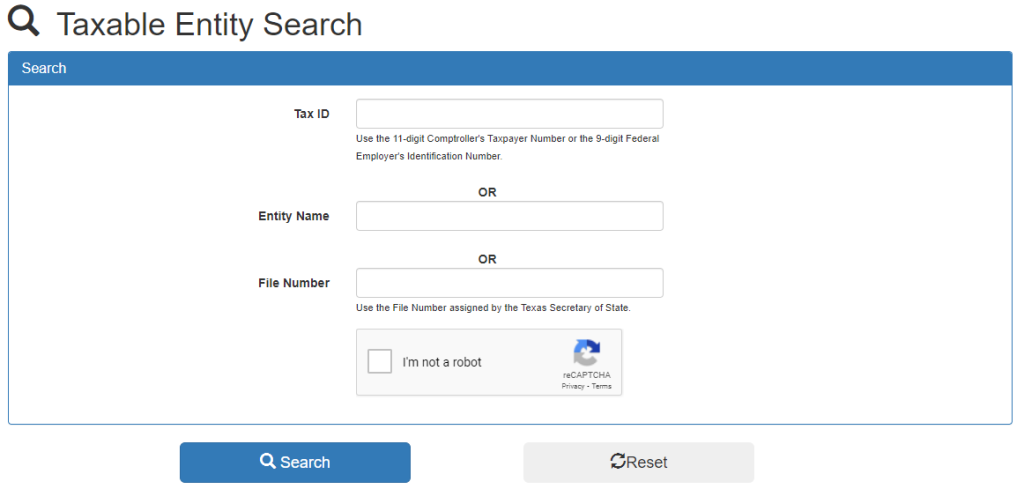

Step 1: Texas Assumed Name Search

You must choose a legal name for your DBA. Therefore you must do the Texas business name search in case of LLC/Corporation or search the county database in case of Sole proprietorship/partnership. This is basically a search where you access the secretary of the state record for registered businesses. You can not take any name that is already registered. Along with this, there is a Texas naming guideline that you must follow to choose your Texas DBA name.

- The business name should not imply that you are a government agency.

- You will need prior permission to use words like “Bank” “University”, etc.

- You can not differentiate your name using Upper or Lower case letters.

- The business name should not convey any illegal purpose.

Step 2: File The DBA at the County Clerk/SOS

Now to file the Texas assumed name certificate you must visit the county clerk if you are a sole proprietor or a partnership business. In case you are an LLC or Corporation owner, you must file at the Texas secretary of state. Let us start with the steps to file at a county.

How To File DBA at Harris County?

You must start to search the Harris County Assumed Name database. You can then confirm whether your desired name is already registered or not. After which you can start to fill out the form. Now there are multiple forms to file based on the number of owners in your Texas DBA.

- 1-3 owners – You must file form 02-07

- 4-13 owners – You must file form 02-07A

- 14 and more owners – You must file form 02-07B

Fill either the form and the mail the application or submit it in person to the following address:

- Office Address:

Visit any of the 10 Harris County locations and drop off your form. - Mailing Address:

Harris County Clerk

P.O. Box 1525

Houston, TX 77251-1525

Also, remember that the form must be notarized. Now, if you are looking to file your Texas fictitious business name in some other County, you can check out the county list from the SOS website and contact them. More or less this is the process to know, how to get a DBA in Texas.

How To File DBA at Texas SOS?

Before filing a Texas assumed name, you must have a valid Texas DBA name. To confirm this, you must do the Texas business entity search. After which you can start filing the Texas assumed name certificate. You can only file this form by mail, fax, or submit it in person. Here are the details for the same:

- Mailing Address:

P.O. Box 13697

Austin, Texas 78711-3697 - Office Address:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701 - Fax:

(512) 463-5709

What is the Cost To File DBA in Texas?

The Texas DBA cost may vary between a county and the Texas secretary of state and within the 254 counties in Texas. Although to give a good understanding of the cost, we have found out the cost range.

Cost To File at Texas County: Filling your Texas fictitious business name at the county may cost between $10 to $20 for the first owner of the DBA. Now for every additional owner, you might have to pay either $.50 or $1.

Cost To File at Texas SOS: To file your Texas DBA at the secretary of state, you must pay a $25 filing fee.

Can I Update My DBA Information?

No, unfortunately, Texas state does not allow any updating of the information on the current application. If you are looking to correct any information or want to update the information of your DBA, you must get a new Texas assumed name certificate with the county or the state.

Do I Have to Renew my Texas DBA?

Yes, you do have to renew your Texas DBA after its service duration is expired. At the time of filing, you have to file in the number of years you want to keep your Texas fictitious business name active. It can be anything between 1-10 years, 10 years being the maximum number of years. You can run your DBA for 10 years and then you will need to renew your DBA by filing a new assumed name certificate.

Can I File Multiple DBAs in Texas?

Yes, you can file as many DBAs as you like. There is no statutory limit on the number of DBAs you can have. You can have the “n” number of Texas assumed names under the same sole proprietorship, partnership, LLC, or corporation.

What if I Don’t Want To Use My DBA Anymore?

If for some reason, you are not able to continue running your Texas DBA or have decided you do not need this DBA any longer. You should then file the Texas certificate of withdrawal of registration which is form 608. This would help you to avoid any legal action in the future.

Frequently Asked Questions

1. Will I have to pay taxes if I register as a Texas DBA?

There is no specific tax for a DBA but according to your business type, you will have to pay taxes to the government.

2. How long does it take to file a DBA?

You may get your DBA registered the same day you submit your information or the day after, in case you submit it after 2 Pm.

3. Does DBA need EIN?

You must already have an EIN, if you are a sole proprietor, in partnership, or own an LLC or a corporation.

4. Will I need an LLC to set up a DBA?

Not specifically, you may run a sole proprietorship, partnership firm, LLC or a corporation to form a DBA. If you set up a Texas DBA without any of this, then you will be recognised as a sole proprietor by default.

5. What are the other names for a DBA?

DBA - Doing Business As, is also known as an assumed name, trade name or fictitious name.

What After I File My DBA in Texas?

The work is not over here, after you get your Texas DBA or Texas assumed name, you must consider a few things. This will help you boost your business at the start and keep things in order. Things like creating a business account separate from your personal one. Creating your business website to attract and engage customers. Also having the right insurance for your business to protect your assets. All this would be the way to may forward with your DBA in Texas.