If you have chosen to start an LLC in Florida, then you must make yourself aware of a few things. This includes the basic guidelines and the complete process of filing and creating your LLC in Florida. It is equally important to understand the gist of the process, along with how much it may roughly cost you to form an LLC in Florida. We hope our guide will smoothen your process.

How to Start An LLC in Florida?

To guide you on how to start an LLC in Florida, we must start with the process. It is generally of 5 important steps. You can choose to file your applications and register your business with the Florida secretary of state. The majority of the process can be done online. You may sometimes need to visit the Florida SOS just in case. Whether you are looking to file a domestic LLC or a foreign LLC, you should go through this process. Here is the overview.

- Florida Business Entity Search

- Choose Your Registered Agent

- File The Florida LLC Articles of Organization

- Create Your Florida Operating Agreement

- Get Your Florida LLC EIN

Here is also the basic information on Florida LLC that will be helpful in the process ahead.

| The Form | Articles of organization |

| Agency | Florida Division of Corporation |

| Filing Fee | $125 |

| Registered Agent Fee | Around $25 |

| Online Filing | Available |

Step 1 – Florida Business Entity Search

The foremost step toward forming your Florida LLC is to think of a business name. Your LLC name should follow the Florida state guidelines. At the same time, you must choose a name that is unique and different from all other Florida LLCs. Once you have decided on the name then you can use the Florida business entity search tool and know whether your LLC name is available or not. Here are the Florida business naming guidelines:

- Your name should be unique and not taken by any other LLCs.

- You must use the word “Limited Liability Company”, “L.L.C” or “LLC” in the name.

- Avoid words like FBI, Treasury, State Department, etc to avoid confusing your LLC as a government agency.

- You must get licensed and extra paperwork to use the name such as Bank, Attorney, University, or individual such as doctors, lawyer, etc.

After selecting a valid name and searching the Florida SOS database, you can choose to reserve your business name. This is optional, as you can also move forward with the process to register your business. Although if you are not registering your business yet or maybe thinking to search for a better name, then in the meantime you can reserve your name. The Florida SOS allows you to reserve your name for 120 days for $25.

We recommend you choose a name that is simple yet portrays what’s your company is about. It would also be a good idea to choose multiple names while doing the Florida business entity search so that if one name may not be available you have another option.

Step 2 – Choose Your Registered Agent (Around $25)

Having a registered agent while forming your business could prove to be very helpful. A registered agent will help you out with all the documents and filing of your business. They will charge their own fees, you must hire a registered agent who is a resident of Florida.

Who Can Be Your Registered Agent?

A registered agent should be a resident of Florida and must follow the government regulations. A registered agent can be anyone from your company, your family or even yourself. Although to become a registered agent you must comply with these rules:

- The person selected as a registered agent must be a Resident of the state.

- You should maintain regular/normal business hours at the address you provided for your registered office.

- In case you are willing to do the business from home, then you must make your address public.

- You must remind the company about the notice, date, and deadline on time.

We recommend that you must select a professional registered agent. Selecting a professional agent is helpful because they are trained for different circumstances. They can help you avoid unnecessary delays and maybe even save money.

Step 3 – File The Florida LLC Articles of Organization ($100)

To create your Florida LLC, you need to file an article of organization with the Florida secretary of state. You can file your Domestic LLC online. In the case of Foreign LLC, you will need an application available on Florida SOS. This article of organization will allow you to legally operate your LLC in Florida. The filing process will take around $100. You can also choose to mail your article of organization. Simply print the form and send it to this location.

Mailing Address

- Department of State: Division of Corporations

Corporate Filings, P.O. Box 6327

Tallahassee, FL 32314

Courier Address

- Department of State: Division of Corporations

Clifton Building, 2661 Executive Center Circle

Tallahassee, FL 32301

We recommend you fill out the article on the organization online to save time. The online process is much quicker and can be processed from outside the state as well.

Step 4 – Create Your Florida Operating Agreement

The next step would be to create an operating agreement for your LLC. This will include the basic information of your LLC. It will also ensure a smooth flow of your LLC from the internal point of view. An operating agreement also draws up solutions for different circumstances to avoid conflicts in the future. Here is some of the information, you can add to your agreement.

- Name of your LLC

- Effective date

- Name of registered agent

- Address and contact of registered agent

- Address of the LLC

- Name and contact of each member

- Share of each member

- Profit and loss ration

- Dissolution date

- Capital raised by each member

We recommend you file an operating agreement because it will see to the smooth flow of operations in your LLC. Although Florida SOS does not ask for this document, you can still get a lot of help from it.

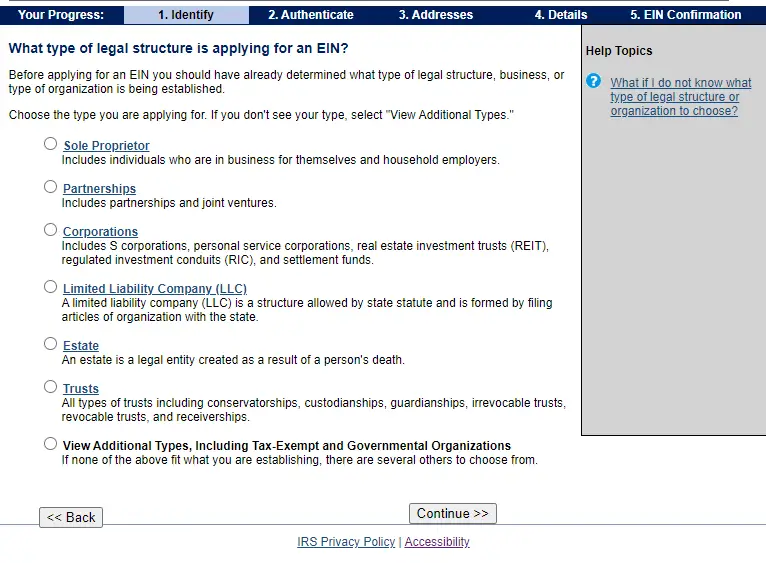

Step 5 – Get Your Florida LLC EIN

It would be wise to get the EIN for your LLC. An employer identification number can help you perform several activities. You can simply file it online in no time from the official website of the IRS. After its filing, your LLC will be recognized as a tax-paying entity. Here is why EIN could be crucial.

- To hire employees

- If you are a tax-paying entity then-employer identification number is a must.

- Perform various financial activities.

- To open a bank account.

We recommend every LLC to file for EIN online, because of its ease of applying and the time it will save. Along with this, it will also allow you to perform some important operations activities.

Florida Foreign LLC Registration

Foreign LLC is for those who are looking to expand their LLC in another state. You can file the foreign LLC application and send it to the Florida secretary of state. It will cost you $100 same as a domestic LLC. You can apply online and print it to mail at the below address

Mail to:

- Division of Corporations

Registration Section

P.O. Box 6327

Tallahassee, FL 32314

How To Get a Certificate of Good Standing? ($5)

Now when you are trying to expand your business in another state, the state government needs an assurance that your LLC is legit and so you will also need a certificate of good standing. The Certificate of good standing shows the overall performance of your Florida LLC in one financial year. Keeping the Certificate of good standing positive you need to work harder on your profits and increase sales. The certificate of good standing is referred to as a certificate of status in Florida. It is essential in many places such as.

- If you want some improvements in your LLC and you are seeking funds for that from banks then you will need the Certificate of status.

- If you want to grow more and expand in a different state then you will require the Certificate of Status.

- A certificate of good standing is required at the time of the renewals of various permits and licenses.

What’s Next After Filing Florida LLC?

Completed filing your Florida LLC? Then you might be thinking that what to do next right? Let us help you out with a few considerations that would be useful next few steps. These steps would help you to run your LLC smoothly and under legal obligations.

Set Up Your Finance & Accounting

To ensure smooth business flow, you must set up your business accounts and take a look at your finance. It will only help you to track your money easily. A few steps we would recommend for all LLCs would be.

Separate Business & Personal Expenses – If you are starting your Florida LLC, then you have to make sure that you are separating all the personal and business accounts. It is necessary to separate as when you form your business and mix up your assets with that, the personal assets are at the highest risk. So it would be helpful if you separate them.

Consider a Small Business Credit Card – Once you complete establishing your Florida LLC it would be beneficial to consider getting a business credit card for your LLC. You can get various rewards and bonuses for getting signed up for a credit card which can be factored in while zeroing down on a credit card that is suitable for your business.

Set Up Accounting Software – If you set up the right account software, it will allow you to track various receivables, what are the cash inflows and outflows of your business. You will (barely) dread tax season as a business owner with a separate business checking account and organized accounting software.

Know Your Taxes

Paying taxes is important and you should be aware of your taxes. These taxes may vary from state to state but you should always pay your taxes and it can also allow some additional benefits with it. Here are a few to remind you of.

Sales Taxes – Sellers permit must be filled by you in case you are selling anything. Whether you are selling the product physically or in any other way, you must file sales tax. It can be helpful to collect taxes from the customers.

Employer Taxes In Florida – If you are having employees in your firm or wishing to hire then you must pay employer taxes in Florida. It is also known as the Florida Re-employment tax.

Federal Requirements – This is the way to report the income of your Florida LLC to the state. It is necessary to file a report showing the income in the current year with the state.

- Form 1065 Partnership Return (most multi-member LLCs use this form)

- Form 1040 Schedule C (most single-member LLCs use this form)

Hiring Employees

Any LLC would require employees and to hire them you must comply with some state laws. Only after getting your EIN from the IRS website, you can start hiring employees for your LLC. Here are a few things you should look at before choosing your employees.

- You should verify that the employee is allowed and able to work in the USA or not.

- You have to report employees as “New Hires” to the state.

- Worker’s compensation must be provided.

File Your Annual Report

All those who have settled up in Florida LLC must file an annual report with the department of state of Florida. You should provide the information related to all the changes in your LLC. Between 1st January and 1st May, the annual report must be submitted. If you forget to file the annual report on time then you have to pay a supplementary fee of $400 on top of the pre-existing fees of $138.75. It is necessary to renew if you want your LLC status “Active” and remain in good standing.

Due Date – Florida’s deadline for filing the annual report is May 1st of each year. Your LLCs first annual report is due the next calendar year after your LLC was formed.

Late Filings – Florida charges a $400 penalty if you miss the May 1st filing deadline. In addition, failure to file your annual report by the third week of September will cause your LLC to be dissolved.

Frequently Asked Questions

1. Do LLCs pay taxes in Florida?

Florida is known to be a tax-friendly state and they do not impose income tax on the individual. 6% is the total sales tax in Florida. Corporations that are having business in Florida have to pay 5.5% income tax. All the LLCsm sole proprietorship and S-corporations are exempt from paying the income tax.

2. How much does it cost to form an LLC in Florida?

If you are willing to form a Florida limited liability company then you will have to be prepared to pay the registration fees that will cost you around $125.

3. Should we attach the Operating Agreement while filing the documents to create Florida LLC?

No, The Operating agreement is not a necessary document in forming a Florida limited liability company. You can save it for future testimonials.

4. Does a Florida LLC have to file annual minutes?

Annual Minutes” must be kept with the business entity itself and they don't have to file with any agency.

5. How long does it take to form an LLC in Florida?

If you have submitted the forms & documents including the registration fees it will take up to 2 to 4 weeks.