Looking to create your LLC in Texas? You just have to follow a simple process and you can establish your LLC in no time. You simply have to understand the process and the guidelines that the government have set. Having an understanding of this can save you time and money. We will get into the details of what you need to do along with how much it may cost you at every stage. Our guide would be a great headstart for you.

How to Start an LLC in Texas?

To start with there are majorly 5 steps that should be of great focus. Some steps can be performed online and some would require you to visit the Texas secretary of state to file your application. This does not suggest that it is tough. Following the steps can help your process move along smoothly. Whether you are looking to form a domestic LLC or a foreign LLC, you would need to do this.

- Texas Business Entity Search

- Choose a Registered Agent

- File Certificate of Formation

- Create Your Texas Operating Agreement

- Get Your EIN For Texas LLC

Before we move forward towards the steps in detail, here is an overview of important details for forming Texas LLC.

| The Form | Certificate of formation |

| Agency | Texas secretary of state |

| Filing Fee (Domestic/Foreign) | $300/$750 |

| Registered Agent Fee | Starting from $39 |

| Online Filing | Available |

| Franchise Tax Report Due Date | May 15 |

| Texas LLC Name Search | $1 for online search |

| Registered Agent Consent Form | $15 (LLC), $5 (Non-Profit Org.) |

| LLC Name Reservation Fee | $40 online/paper filings |

Step 1: Texas Business Entity Search [$1]

The foremost step to forming a Texas LLC is that you have to select a valid and legal business name. Your LLC name must be unique and different from other LLCs in the state. To ensure this, the Texas secretary of state has the Texas business entity search tool. Using this you can search whether your desired name is available or not. Moving on you should think of a name that follows the government guidelines:

Texas LLC Naming Guidelines

- You must include either of these words such as “Limited Liability Company”, “LLC”, “L.L.C”, “Limited”, or “Ltd” at the end of your name.

- Your name should not include words like FBI, state department, treasury, etc to implicate that you are a government agency.

- There are few words that you can use only if you have a valid license. Such as Attorney, bank, university, doctor, etc.

- Upper case and lower case have no distinction in the name.

After you find your business name, you can also opt to reserve your LLC name. Businesses generally reserve their name when they are not looking to register their business at the moment or when they are still in search of a better name. You can reserve your business name for 120 days (4 months) for $40.

We Recommend you should select a name that is simple & easy to find so that the customer can easily remember it. Although your name should be such that matches what your business is offering and match your vising and mission in the long term.

Step 2: Choose Your Registered Agent [$49]

Once you have completed the Texas business entity search, you can think of hiring a registered agent. They are specially trained to understand the processes and overcome challenges. They will help you keep a complete record of your business documents and move the process faster. It also releases you from the worry of forgetting any document or missing out on any steps.

Who Can Be Your Registered Agent For Texas LLC?

Many businesses are not familiar with this but anyone can become a registered agent. It means that anyone who is a resident of the United States can become or act as a registered agent. You must follow certain government rules to become a registered agent. Here are those who can become registered agents.

- The registered agent should be a resident of Texas United States of America.

- Anyone from your family or friends & employee can be the registered agent.

- You are free to hire a registered agent, however, he/she should resident of Texas state.

We recommend you choose a licensed & professional registered agent to start your Texas LLC. They have experience forming LLCs and can move your registration process smoothly without wasting time. You can also be involved in the process and solve your related queries.

Step 3: Filing Certificate of Formation [$300]

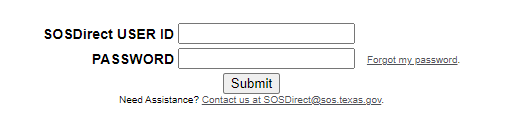

You must file the certificate of formation to legally create your business in Texas. The application for domestic LLCs and foreign LLCs is different. Form 205 is for domestic LLC and form 304 is for foreign LLC. You must file them and submit them to the Texas secretary of state. You can do so in three ways, either file online, by mail, or visit the SOS to submit it personally. If you are looking to mail your certificate of formation, then here is the address.

- Corporations Section

Secretary of State

PO Box 13697

Austin, TX 78711

We recommend you choose the online procedure as it is one of the fastest ways to register your LLC. It will save you time and you can in the meanwhile move on with your process.

Step 4: Create Your Texas Operating Agreement

A legal document is very necessary for an LLC to run its operations. This agreement is not created by the government. The business must create its operating agreement. It will include information related to your LLC. Some states may ask you to file this and some may not. Here is the basic information that must be included in the operating agreement.

- Name of the LLC

- Address of the LLC

- Duration of the LLC

- Registered agent’s detail

- Effective date

- Dissolution date (if any)

- Name & principal place of Business

- Purpose of the LLC

We recommend getting an operating agreement once your LLC gets formed. You can use online services as well to create your operating agreement. It will help you to maintain your LLC status for a longer period.

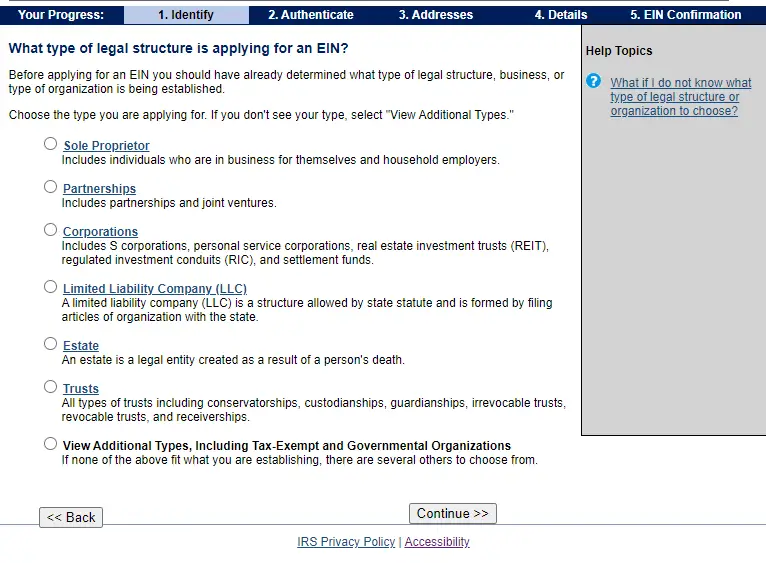

Step 5: Get Your EIN For Texas LLC

EIN, the Employer identification number is a really important part to form an LLC in Texas. You can issue the EIN from the Internal Revenue Services (IRS) if you want to hire employees for your company. It is a legal requirement. You will have to visit the official website of IRS to get your EIN & fill out the form SS- 4,

Why EIN is helpful?

- In case you want to open a bank account in the name of your LLC, then you must have EIN.

- It is helpful for IRS to track your taxes.

- Hiring employees for your firm.

We Recommend getting your Employer identification number as soon as your LLC is confirmed. It is necessary for performing any financial activities or to open a bank account in the name of your Texas LLC. IRS describes you as a tax-paying entity if you are having EIN.

Texas Foreign LLC Registration [$750]

Foreign LLC is for those who are having their own business in any other state but want to expand their business in Texas. So, to expand your LLC, go for a foreign LLC in any other state. You can either file it through the online method or else through Mail. The process is similar to that of a domestic LLC, just you have to file a different form which is form 304. Along with the form you have to provide a certificate of formation. You will be required to pay an amount of $750 for forming Foreign LLC. You can send the document here:

Mail to:

- P.O. Box 13697

Austin, TX 78711

Submit In-Person:

- James Earl Rudder Office Building

1019 Brazos

Austin, TX 78701

Fax:

- 512-463-5709

How to Obtain a Certificate of Good Standing [$15]

It is necessary to get your certificate of good standing if you want to expand your business and operate it in other states. You may also find it being referred to as a certificate of status in the state of Texas. Here we have provided a few instances in which you might need the certificate of status of your Texas LLC.

- You can Seek funds from banks or other lenders

- You will need this if you want to form your LLC in another state as a foreign LLC.

- If you want to get or want to renew your license and permits then the certificate of good standing is a must.

What’s Next After Filing Texas LLC?

Once you complete forming your Texas LLC, you should have a look at the after filing process. It is not that you create your LLC and your work is completed, No, you should set up a few things to ensure that your LLC will operate smoothly. Here are a few considerations to look at after filing your Texas LLC.

Set Up Your Finance & Accounting

Setting up your finance and accounting is the base to keep a check on your cash flow and revenue. It will maintain the records of your finance from day 1 and would be helpful to track any money whenever required. Consider doing this while setting up your finance and accounting:

Separate Business & Personal Expenses – Keeping your personal and business assets together could be a risk in the future. If you will keep your personal and business accounts separate then it can help you to keep your assets safe. It can also help to manage your money more effectively.

Consider a Small Business Credit Card – It is smart to consider getting a business card once you complete establishing your Texas LLC. Do you know that which one is right for you and what should you examine before choosing that? During the initial period of your business factors such as 0% intro APR can help your business to carry an interest-free balance.

Set Up Accounting Software – You can track your account receivable if you are having the right business accounting software. It also tracts the money that is flowing in and out of your business. To simplify the year-end tax burden of your Texas LLC this can be considered an important document.

Know Your Taxes

Taxes are very important to file and you should be aware of your tax information. Taxes may vary based on the nature of your business and the state you are operating your LLC. There are three types of taxes that you should comply with that is sales tax, federal tax, and Employer tax.

Sales Tax – If you are willing to sell any product in your Texas LLC, then you have to file sales tax. For this, you have to register the seller’s permit through the Texas Comptroller of Public Accounts.

Employer Tax – You should register unemployment insurance tax if you are having employees in your firm. This can be done through Texas Workforce Commission on behalf of your employees.

Federal LLC Tax Filing Requirements – Mostly all the LLCs must report their income with IRS every year. Federal tax can be affected by how you pay as an owner.

Hiring Employees

Employees are the base of any LLC operations. So to hire employees for your Texas LLC, you should know that there are various rules to hiring them. Some of them are:

- You must verify whether the employee is allowed to work in the US or not.

- You have to report employees as “New Hires” to the state.

- Worker’s compensation must be provided.

File Your Annual Report

The annual report contains information and changes in your LLC that occured during the year. You must file your report to the government. Some states may require you to file this, some may not. The Texas government do not ask for annual reports from any Texas LLC. Although there is something you should be aware of.

Tax Calculation – LLCs with annualized revenue below $1,130,000 do not pay any tax, but must file a “no tax due report.” LLCs with annualized revenue greater than $1,130,000 pay a graduated tax that is calculated based on a complex formula.

Due Date – Due by May 15 each year. Reports do not need to be filed in the same year that an LLC is formed.

Late Filings – Texas charges a $50 penalty for failure to file on time (whether or not you have tax due). Additionally, a late tax payment is subject to a 5% penalty fee, which increases to 10% if you pay after 30 days.

Frequently Asked Questions

1. What is the time taken to form your Texas LLC?

It usually takes 1 business day to form a Texas LLC if you are doing the process online. If you are mailing the documents then you may have to wait for 3-5 business days.

2. What is the cost to form Texas LLC?

If you want to form an LLC in Texas then may have to pay $300 to form the domestic LLC. If you are willing to form a Foreign LLC then you have to pay $750 as filing fees.

3. Do you need the Seller's permit if you sell the products online in Texas?

Yes, you will need the seller's permit if you are selling the products online from your texas LLC. As you will collect taxes from the online payment gateway.

4. Is the Employer Identification Number necessary for Texas LLC?

Yes, you should have the EIN in order to hire new employees in your LLC in Texas.