When you are planning to start your business in any state the foremost step you must know is how you can register it. If you are looking for starting an Illinois LLC then you must know the process along with its cost to start working. To file the legal documents in one go you must know the steps. Refer to this guide to know how to start an LLC in Illinois. We have curated easy steps for you to form an LLC in the state.

How to Start an LLC in Illinois?

We will preciously brief you on Illinois LLC formation through 5 easy steps. There are two types of LLCs that you can form in Illinois. One is a domestic LLC for which the filing form and procedure are different.

Whereas, if you want to expand your business you will need to file a foreign LLC form. Both the forms will allow you to legally operate your business in Illinois. The 5 steps to forming your LLC in Illinois are the following:

- Illinois Business Entity Search

- Hire an Illinois Registered Agent

- File Illinois LLC Articles of Organization

- Create Illinois LLC Operating Agreement

- Get your LLC an EIN

Walk through the following details to get a brief idea of Illinois LLC formation. The below-given table will give you a better understanding.

| The Form | Articles of Organization |

| Agency | Illinois Secretary of State |

| Filing Fee (Domestic/Foreign) | $150 |

| Registered Agent Fee | $50 to $300 |

| Online Filing | Available |

| Franchise Tax Report Due Date | June 30th |

| New Jersey LLC Name Search | Free |

| LLC Name Reservation Fee | $25 |

1. Illinois Business Entity Search

To start with the process, the foremost thing you will need to do is decide the name of your LLC in Illinois. You will have to pick out the name which is legally available in the state and is valid. To check the name availability you will have to learn how to perform an Illinois business entity search.

The results will help pick out a unique name for your LLC. You will also be able to see the active & dissolved LLC names by using this search tool. Once you check the name availability you must ensure your desired Illinois LLC name meets the LLC naming guidelines.

- Ensure to add Limited Liability Company or its abbreviations like LLC or L.L.C at the end of the name that you select

- The name should not confuse itself as a government agency by using the names like treasury, FBI, or state department

- Do not use words that baffle customers or else your LLC could end up facing consequences

- Take permission from the Illinois SOS while using certain words like bank, attorney, dentistry, or university

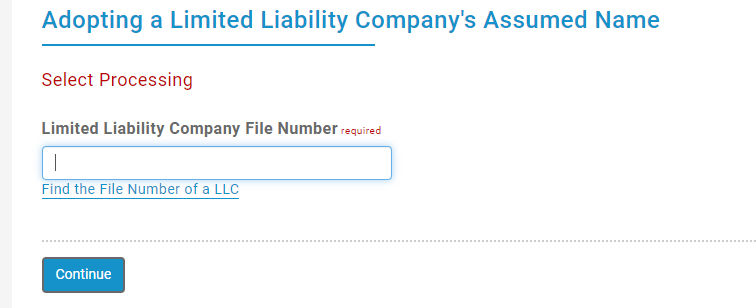

If in any case, you are not yet ready to start your LLC, you may reserve it. The name reservation can cost you $25 and it will reserve the name for 120 days with the Illinois secretary of state.

We recommend you pick a name that describes the type of business that you will carry out in the state. It should match the vision and mission of your business. Ensure to follow the naming guidelines.

2. Hire a Registered Agent

A registered agent is a professional individual who is trained enough to look forward to the LLCs legal documents. They are responsible candidates who respond to all the notices of the government and other leading companies.

An Illinois registered agent acts as a point of contact between the state and the government. A registered agent will let you know about all the important filing dates and documents sent by the state department. They should comply with the following points:

- Available at the address provided to the state during working hours

- Notify the owners about the legal notices and deadlines on time so that they do not miss out

- Should be flexible to work for the LLC by making their address public

- Should be able to maintain the responsibilities & sign the legal documents

Who can be my Registered Agent?

A registered agent of an LLC in Illinois can be anyone. You can appoint anyone from the company or even can be your agent. It can either be anyone from your family or your friends. Unless they meet the requirements of the state, anyone can be Illinois LLC’s registered agent. Make sure you know the procedure and forms to appoint a suitable Illinois registered agent for your LLC.

We recommend you avoid being your own registered agent to help you save time and not be restricted by the rules.

3. File Illinois LLC Articles of Organization

After hiring a registered agent you will have to officially form your LLC in the state. To do that you will have to file articles of organization with the Illinois SOS. The document will help you legally operate your company as an LLC in the state.

You will have to fill out the form LLC-5.5 Articles of Organization and file the form with the Illinois secretary of state either online or via mail. Along with the form you will have to pay a $150 filing fee (non-refundable). The process of filing the Illinois articles of organization is easy and you can do it by following the easy steps.

Mail Address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62746

Note: The processing time that the article of organization will take is within 10 days. But, if you wish to get the form within 24 hours, additional expedite fees should be paid.

4. Create Illinois LLC Operating Agreement

You have to create your operating agreement once after you form your LLC. The operating agreement is not a document that the secretary of state asks you to file. It’s not mandatory but will help you avoid conflicts and litigation between LLC members.

This agreement acts as proof in case your LLC ends up in court. You must draft the document carefully by following the correct method. You can either take a professional’s help or draft on your own. We recommend you take a professional’s help to know how to draft an Illinois LLC operating agreement.

An operating agreement should include the following information.

- LLC name

- The formation date of your LLC

- The valid address of your LLC

- Registered Agent

- Operating address of your registered agent

- Details of each member of the LLC along with their signatures

- Type of LLC

- Dissolution date (if any)

We recommend you draft an operating agreement while you form an LLC. You can make changes and keep copies of all the agreements in your business records for future reference.

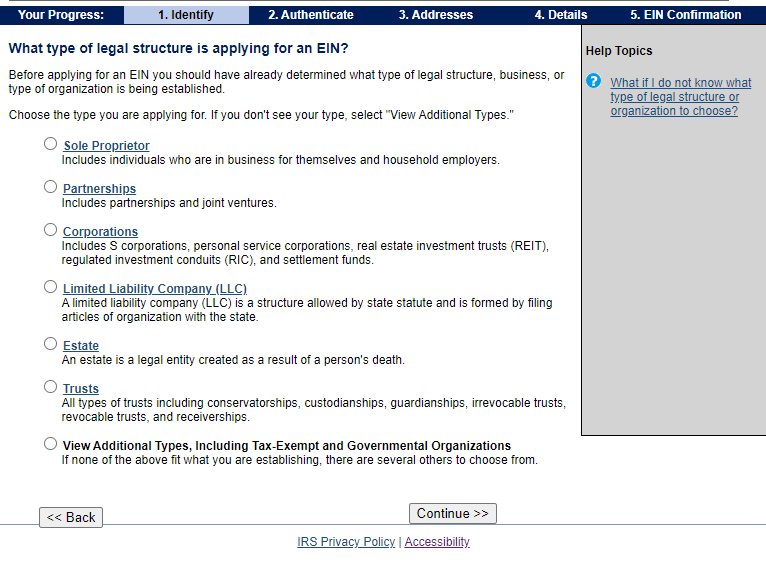

5. Get Your LLC an EIN

As soon as your LLC in Illinois is formed, it is necessary for you to get an EIN. Employer Identification Number acts as social security for every business entity in the state. It is given by Internal Revenue Services (IRS) after requesting it.

You will need the EIN in several matters such as:

- Opening a business bank account

- While hiring a new employee for the LLC

- It is helpful in managing state and federal taxes

- All the financial activities will be easily carried out with the help of an EIN

We recommend you claim the EIN as soon as you form your LLC so that you can move further with the processing. Request it online so that you can get it as soon as possible.

Illinois Foreign LLC Registration

If you wish to expand your existing business in Illinois, you will have to file a foreign LLC with the state. The form will allow you to operate as a single entity in multiple states. The filing will cost you $150 and you will have to file the form via mail. You will need to file the foreign LLC registration with the certificate of good standing to the Illinois secretary of state.

Mail to:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

How to Get a Certificate of Good Standing?

When you wish to expand your business in another state, you will have to submit proof of your LLC being registered in Illinois. In such an instance, you will need the Certificate of Good Standing to show that your Illinois LLC was legally formed in the state and well maintained.

You will have to pay your taxes on time and all your permits should be renewed. You will not be able to request the certificate by mail, thus request it online. The Certificate of good standing will come in handy to request funds from leading companies/banks and renew licenses.

Thus, make sure you know to obtain the document online from the official website of Illinois SOS.

What After Filing LLC in Illinois?

The legal process of forming an LLC might be over but there are other considerations that are equally important for an LLC to run smoothly. After you have successfully formed your Illinois LLC in the state, here is where your focus should be next.

Plan Your Finances & Account

Start with the basics and set up your accounts and finances. You must know how your cash flows in the LLC and its usage. You must consider doing the following while setting up your business:

Separate your Personal & Business Accounts: We will recommend you separate your personal accounts from your business accounts. Your personal expenses should not be a part of your business accounts. It can create confusion in the future. Thus, make sure you open a separate business account for your LLC in Illinois.

Consider a Small Business Credit Card: Once you complete the formation it is recommended that you consider getting a business credit card. It will help you track your LLC spending. Also helpful in categorizing the year-end taxes of an LLC.

Set Up Accounting Software: Select the right accounting software to track your receivables correctly. Along with that, you will surely be able to track your money inflow and outflow of the business. To achieve success and profit for your LLC, accounting software is really very helpful.

Know Your Taxes

There are a few taxes that your business has to pay depending on the type of your LLC. There are different kinds of taxes that you have to pay as an LLC to the government. Following are some of the taxes you must know about:

Sales Tax: You will need a seller’s permit if you are a seller selling different products to the consumer in the state. You can visit the MyTax Illinois website to get this tax. Sales tax is also known as “Sales and Use Tax”.

Employer Tax: On behalf of your employees you will need to pay Unemployment Insurance tax and Employee Withholding Tax. Visit the MyTax Illinois portal to pay this tax online.

Federal Tax: Most LLCs in Illinois have to report their income to the Internal Revenue Service (IRS). Every year LLCs in the state of Illinois has to report their income. On the basis of the type of your LLC, you will have to file the form with the state.

- For single-member LLC you will need to file a form 1065 Partnership Return

- For multi-member LLC you will need to file a form 1040 Schedule C

Hiring Employees for LLC

There are certain rules that you need to comply with while hiring an employee for your Illinois LLC. There are certain rules of the Illinois government that you need to follow to hire an employee.

There’s not much of a hassle to remember what is required to appoint the right candidate for your LLC in the state.

- Every worker in the LLC must get their compensation from the LLC they work in

- Any employee you hire should be able to work in the United States with their own consent.

- The employee that you hire for your Illinois LLC should be registered as “New Hires” to the state

- They must be responsible enough to handle legal situations

File Annual Report With the State

Every entity in the state of Illinois has to file an annual report with the secretary of state per year. It is compulsory to report the details of your LLC to the state. You can report the annual information of your business via mail, online, or in person.

- Online: To file the annual report online you will need to visit the secretary of state website. The filing cost is $150 which is non-refundable.

- Via Mail: You can file the report via mail by downloading the pdf form of the document and filling it out. The filing fee is $75 if you mail the form to the SOS.

- In-Person: You can visit the SOS division to file the annual report of your Illinois LLC. Make sure you carry the filing fee with you.

Mailing or In-Person Address:

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Due Date of Filing Annual Report: The due date for filing the report is the first day of the month in which the LLC was formed per year. Make sure you have to file the report 60 days prior to the due date with the Illinois SOS.

Late Filings: If you miss out on the due date for any reason you will have to pay $125 extra if the method of filing is online. $75 is the extra fee that you will have to pay if the method of filing is via mail. Even after that, if you fail to file the report then your LLC will be dissolved within 180 days.

Frequently Asked Questions

1. If my LLC is multi-member then which form do it have to file to pay federal taxes?

Multi-member LLCs have to file form 1040 Schedule C to pay federal taxes.

2. How much does certificate of good standing cost in Illinois?

In Illinois, the certificate of good standing costs $25 and you need to request it online.

3. What is necessary to file foreign LLC?

To file a foreign LLC you will fill the form online and register your foreign LLC by paying $150 fees. Make sure to attach a certificate of good standing with it.

4. What is the cost of filing the Illinois LLC annual report?

The cost of filing the annual report of your LLC in Illinois online is $150 & by mail, the cost is $75.

5. When can SOS dissolve my Illinois LLC?

If you file the annual report late then Illinois SOS can dissolve your LLC within 180 days.