If you want to legally structure a business in any state you must know how to set up an LLC. Planning to start your new business in North Carolina? Our guide will be the key to knowing how to form a North Carolina LLC.

Go through this article to know the process, cost, and registration methods that will help you set up an LLC in North Carolina. Our complete guide will smoothen the process and help you understand what needs to be done.

How to Start an LLC in North Carolina?

To set up an LLC in North Carolina, you must register your business with the secretary of state. The process is divided into 5 steps. These 5 steps could ease your work and give you an idea about how to move forward. You can commence the process either online or by mail. We will focus on both domestic LLCs and Foreign LLCs.

- Complete a North Carolina Business Entity Search

- Hire a Registered Agent

- File a North Carolina Articles of Organization

- Create a North Carolina LLC Operating Agreement

- Get Your EIN

Let us get into the details of each process to help you form your LLC in North Carolina. Here is also the basic details that would help you throughout the process.

| The Form | Articles of Organization |

| Agency | North Carolina Secretary Of State |

| Filing Fee (Domestic/Foreign) | $125/$250 |

| Registered Agent Fee | Around $50 to $300 per year |

| Online Filing | Available |

| LLC Name Reservation Fee | $30 |

Step 1: North Carolina Business Entity Search

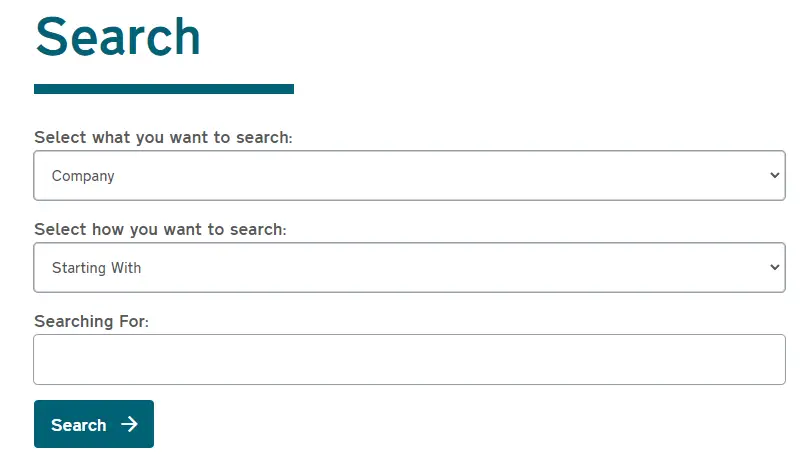

The initial step when you form a North Carolina LLC is to set up a name that is unique for your business in the state. Pick a name that suits the type of business you are going to run in the state. Make sure the name you pick is available in the state and no other entity is using it.

To check the name availability you have to conduct a North Carolina business entity search online. Your name should also follow the naming guidelines to not be rejected by the secretary of state.

If under any circumstances, you are not going to immediately form your LLC, you can also reserve the name which will restrict others to allow it. It is optional but if you wish to reserve the name then the North Carolina SOS will process your request. This service will cost you $30 and you can reserve the name for 120 days. Once you are sure about the name, you can register your business with the state department.

Note: You can reserve multiple names at once but have to process the application & pay the fees as many times as you reserve the name with the North Carolina secretary of state.

Step 2: Hire a Registered Agent [Around $50 to $300]

Appointing a registered agent proves to be very helpful. They help you settle the legal records and also file your documents to form your LLC. Agents will be the medium between the business and the government. They might charge you anything between $50 to $300 per year. Make sure you are hiring a legal registered agent, here is our guide to explain to you how to hire a North Carolina registered agent.

Who Can be Your Registered Agent?

A registered agent must have a North Carolina street address and must be a resident of the state. You can appoint your business partner or anyone else from the business to be your registered agent. Along with this, your family member or yourself can also be your LLCs’ registered agent. Just keep the following in mind:

- Registered agent’s age must be 18 or above

- The agent should be a North Carolina resident with a street address.

- Your address must be public either at the office that you will work from or your home.

- Legal notices should be communicated with the owner.

We recommend you hire a professional registered agent and not be your own agent. It will make your work easy and you will be able to concentrate on company-related work.

Step 3: File a North Carolina Articles of Organisation [$125]

To legally form your LLC in North Carolina, you have to mandatorily file articles of organization with the North Carolina secretary of state. You can either file the document online or mail it to their address. This document will allow you to legally operate your North Carolina LLC amongst other entities.

This process will cost you $125. You can print out the pdf form of the document and mail it to the given address or you can visit in person to file it. Here is our guide on North Carolina articles of organization for a detailed process.

- Mailing Address:

The Secretary of State

Business Registration Division

PO Box 29622

Raleigh, NC 27626 - File In-Person:

2 South Salisbury Street

Raleigh, NC 27601

Note: The processing time for articles of organization will be around 5-7 business days.

Step 4: Create a North Carolina LLC Operating Agreement

While in a few states creating an operating agreement is mandatory, North Carolina SOS does not ask any LLC to mandatorily submit the operating agreement. Although, it is highly recommended that LLCs do draft it to avoid any future conflicts. Even if in any case if your company ends up in court, an operating agreement plays an important role in being proof. Check out our guide to understand how you can draft a North Carolina operating agreement. Here is a list of information, you will need to include in your document.

- Name of the company

- Company’s address

- Formation date

- Registered Agent

- Registered agent’s address

- Owners’ & employees’ details

- Details of share of profit & loss

- A hypothetical example of dissolution

Note: Draft your operating agreement to avoid future conflicts and to ease other processes like opening a business bank account.

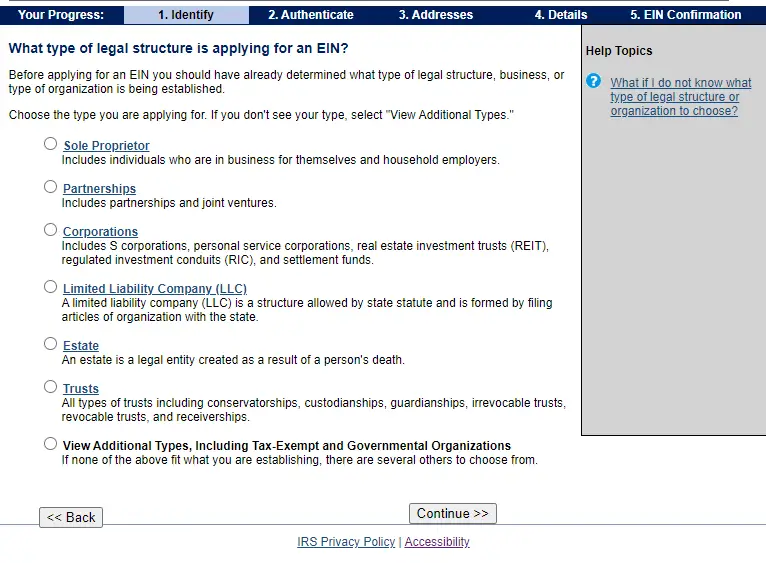

Step 5: Get Your North Carolina LLC EIN

It is preferred that you get an EIN for your LLC in North Carolina. EIN stands for Employer Identification Number which helps secure your company and perform several legal activities. The number socially secures your LLC and is assigned by Internal Revenue Service (IRS). Following are the reasons you should know why EIN is important for the business that you are going to run in the state.

- To appoint an employee for your company

- If your company is paying taxes then you must have an EIN

- Crucial to carry out various financial activities

- While opening a business bank account

We recommend you apply for an EIN online which is an easy process and carry out important activities that will save you time.

North Carolina Foreign LLC Registration [$250]

You can expand your LLC in North Carolina even if your business is registered at another location. Simply fill out the Certificate of Authority for the limited liability company and file it with the state. It will cost you $250 if you mail the form once after downloading it. But, if you file the form online then you will have to pay $253.

- Mail Address:

NC Secretary of State

Business Registration

P.O. Box 29622

Raleigh, NC 27626-0622

How to get a Certificate of Good Standing? [$10]

A certificate of good standing is the existence proof of your North Carolina LLC in the state. When you decide to expand your business, you certainly will need a Certificate of Good Standing. The overall performance of your company from keeping the sales high and working on your profits is shown in the document.

In North Carolina, the certificate of good standing is also known as a certificate of existence. You have to pay a $10 filing fee to get this document from the North Carolina SOS. While it shows the good reputation of your company in the state. It is essential in various circumstances like:

- If in any case, you are seeking out funds from the bank, they will ask for a certificate of good standing to check on your records.

- If you are planning to grow your North Carolina LLC then you will need a certificate of existence as it acts as a proof

- While requesting the renewal of various permits and licenses, you will need a document of good standing

What to do After Filing LLC in North Carolina?

Once you successfully file the LLC in North Carolina you can step further. Once you check all the five steps to form an LLC you must know there are various other things to consider. The following tips will help you run your company legally in the state with obligations.

Arrange Your Finances & Accounts

It is necessary to look up to your accounts and set up smooth and flowy finances. The clean records of your business finances will help you in the future and you will get a positive good standing. Some of the tips we have listed for your North Carolina LLC are as follows:

Split your business & personal expenses: It is important to maintain a professional veil between your personal accounts and business ones. When you start your North Carolina LLC, it is mandatory to separate your business liabilities. In that way, you will be able to avoid the risk of compromising your personal assets.

Get a business credit card: After you successfully open a business bank account for your LLC, you must consider getting a business credit card. It will be beneficial for all the expenses of your business and eventually, you’ll know after a month how the expenses are running around. Additionally, you will also be able to earn reward points as well as claim various bonuses by signing in to the credit card program.

Set up accounting software: While you decide to set up accounting software, you will certainly be able to track all the details of your finances. It will make your work easier as you will know all the outflows and inflows of your business. You will be able to easily pay taxes and know the right due date which will allow your business to stay in good standing.

Get business insurance: To manage the risk of your business, it is a must to get insurance. It will allow you to focus and grow your business. There are multiple types of insurance such as general, professional liability insurance, and worker’s compensation insurance.

Understand Your Taxes

You must be aware of the taxes that you have to pay. The taxes may vary from state to state and you must pay them on time. You will be able to claim the benefits as well while paying the taxes on time. Following are the few taxes that you must know about:

North Carolina Sales Tax: A sales permit is necessary if you are selling a physical product. A business can collect tax on taxable goods with the help of this text. To register you have to visit the secretary of state website.

Employer Tax: You will have to register the employees by filling out the unemployment insurance tax via the North Carolina division of employment security. Along with that, you have to sign up for Employee Withholding Tax with the department of revenue.

Requirements of Federal Tax: Every year, LLCs have to file their annual income report with the IRS. Depending on the type of business there are different forms. If your LLC in North Carolina is multi-member then you have to file a Partnership Return Form whereas, for single-member LLCs, the Schedule C form is important.

Hire Suitable Candidates

You must hire employees who are suitable for the business that you are going to run in the state. The employees must be noteworthy in their work and should be able to deliver what the company expects from them. After getting the Employer Identification Number (EIN) from the IRS website, you will be eligible to appoint an employee for your North Carolina LLC.

To do so you have to follow some state laws as well. Furthermore, there are a few things as well that you must keep in mind while hiring an employee for your company. They are as follows:

- Employees that you select should be able to work in the USA with their own consent

- Ensure to report the candidate that you hire as a “new hire” to the state

- Compensation for each worker is a must

File Yearly Report With the State [$200]

With the department of state of North Caroline, all LLCs have to compulsorily file an annual report. Before the due date of each year, the annual report must be submitted. The report will contain all the details of changes that have occurred in the year. You will be able to either file it online or by mail and the report will cost you $200 which is a nonrefundable fee.

- Mail Address

Secretary of State

P.o. Box 29525

Raleigh, NC 27626

Due Date: The first annual report of your North Carolina LLC has to be filled on the same calendar date your LLC was formed after a year. Whereas, the due date to file the report is April 15th each year.

Late Filings: North Carolina department of state will not charge you extra fees if you file the report within 60 days. But, if you do not file the report within the given period, the NC department of state will automatically dissolve your LLC.

Frequently Asked Questions

1. What is a certificate of good standing known as in NC?

A certificate of good standing is also known as a certificate of existence in NC.

2. What is the cost of forming an LLC in North Carolina?

The cost of forming an LLC in North Carolina is $125.

3. How much does it cost to file an annual report with the state?

$200 will be the cost to file an annual report with the state.

4. Does NC charge if the annual report is filed late?

No, North Carolina will not charge if you file the report late but after 60 days it will dissolve your LLC in the state.

5. How long does it take to process an articles of organization in NC?

It takes up to 5 to 7 business days for articles of organization to process in North Carolina.