All LLCs require the filing of the Articles of Organization which is the official proof of your LLC formation in the state. Those looking to form a limited liability company in CA must be aware of the details this document requires. Follow this simple guide to file your California Articles of Organization with all the necessary details to avoid any issues in the future.

What is a California Articles of Organization?

This is an official document that owners (or business organizers) have to fill out when forming an LLC in California. A successful filing of your California Articles of Organization officially registers your business in the state. This form requires information such as LLC’s name, physical address, Agent’s info, etc. You may complete this document yourself or hire a business organizer

Why File Articles of Organisation with the CA SOS?

The California secretary of state requires you to file this document because of several reasons. Your California Articles of Organization will mention all the necessary info. that the state will require in the public business records. So It’s legal proof of your LLC’s existence in the SOS website’s public records. This document also helps with opening a business bank account, applying for loans, and issuing shares.

What Information is Needed in the Articles of Organisation?

You’ll need to fill out 4 major articles in your California Articles of Organization document. Here’s a guide to filling out this information accurately.

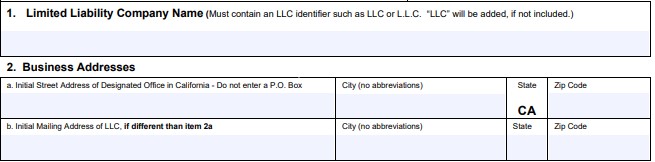

Article 1: LLC Name and Address

The first necessary detail is the name and address of your California LLC. Besides having a catchy business name, your name must be legally correct to use in CA. As a general rule, your LLC name –

- Should meet the California business naming guidelines

- It must not be already in use by another California business. Help yourself with a California business name search to find available names.

- Should not have words that create confusion with a government agency

- Cannot have words from other business structures like corporation or inc.

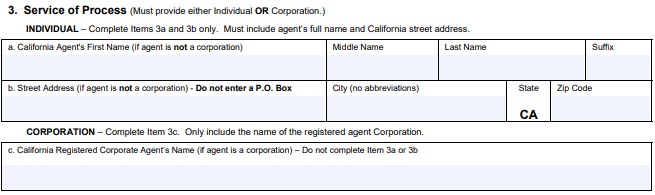

Article 2: Registered Agent’s Name & Address

In the next section, you’ll have to provide details of your CA registered agent to handle the service of process. Simply fill the A & B section if your agent is an individual person. Fill the C section if you are appointing a professional company. Before filling the section, you must know that the individual –

- Must be above 18 with a physical address in California.

- Should be always available at the provided address to receive mail documents.

Article 3: Management Authority

This section will need details regarding how many candidates will manage your LLC. You may select one/more managers or give all your LLC members the managing authority. To make this simple, for a large size LLC, you should select one or more managers. On the other hand, it makes more sense to select all members if your LLC is small. This way, each person can help you with day-to-day operations.

How To File My California Articles of Organization?

Your California LLC formation begins with filing the Articles of Organization with the California SOS. You may either choose to file this online or via mail. Both will require a filing fee of $70.

Online Filing: Simply head to the CA Secretary of State’s bizfile online platform to start your online LLC registration. Create an account and proceed with the necessary steps to pay the filing fee online.

Mail Filing: Another option is to fill in the online PDF form, download it and mail it to the secretary of state. You can mail it to-

Secretary of State

Business Entities Filings

P.O. Box 944228

Sacramento, CA 94244

You may also submit the form in person, which also requires an additional $15 fee. Visit the CA secretary of state office –

1500 11th St.

Sacramento, CA 95814

Can I Change My LLC Name In the California Articles of Organisation?

Yes. If the current name no longer suits your business, you can always change the name of your LLC. Simply, file the application for name Amendment of Articles of Organization with the California secretary of state. This requires a $30 filing fee plus an optional $5 certification fee.

How Much Does CA Articles of Organisation Cost?

While submitting your California Articles of Organization online or by mail, you’ll have to pay a $70 filing fee and an optional $5 certification fee to the secretary of state. For in-person submissions, you’ll be charged an extra $15 at the SOS office.

What is the Approval Time For The Articles of Organisation?

The SOS will process online filings within 3-5 days. For mail filings, it may take about 2-3 weeks for approval of your LLC formation. This includes 5 business days for the processing plus the time taken for documents to reach by mail. If in a hurry, you have the option of expediting processing with an additional fee.

What After My California Filing Process?

It is advisable to finish the following tasks after filing your California articles of organization with the secretary of state. This will build a strong foundation for your business.

Create the operating agreement: In California, creating an operating agreement isn’t mandatory but there are many benefits to doing so. Your California LLC operating agreement will outline the ownership and member roles of the LLC. The operating agreement is your LLC’s private record and it’s not available to anyone online.

Get your EIN: EIN stands for an Employer identification number. The CA state assigns this unique social security number to all registered businesses. EIN plays an important role to open a business bank account, and hiring employees. In California, the IRS will issue you a free EIN, online, by fax, or via mail.

Get your business license: It is your responsibility to figure out whether your LLC will need any specific licenses or permits to conduct the business. Depending on your business niche, you may need a federal, state, or local license.

Open a Bank Account: It is wise to separate out your business and personal bank accounts as it secures your business’s corporate veil. Having your personal account and business account the same will put your personal possessions like – your home, car, and other assets at risk in an unfortunate lawsuit against your LLC.

Frequently Asked Questions

1. Do I have to pay the $800 California LLC franchise tax for the first year?

No. Under new rules, any LLC, LLP or LP doesn’t have to pay the $800 minimum annual tax for the 1st year.

2. What details do the Articles of Organization carry?

A typical article of organization document would need your business name, address, registered agent’s name & address, the purpose of your business, governing authority, and in some states also the registered agent consent details.

3. How long will it take to process my California Articles of Organization?

Online filing usually takes 2-3 days while filing the documents by mail can take up to 5 days once the documents reaches the SOS office.

4. Does Califonia LLCs have to file annual report?

All California limited liability companies and corporations have to file a Statement of Information every year, which is quite similar to what's known as an annual report in most states

Remember This

You should not make any mistake while filing your California Articles of Organization. Any mistake such as an invalid name, ineligible or wrong agent details will result in denial of your business formation. All the money you spent will go in vain and you’ll again have to file the formation documents. It is advisable to use some professional help to make the process seamless.