Wish to start your LLC in Ohio? Certainly, the foremost thing you have to do is register your business by filing the Ohio articles of organization. To officially operate your business in the state you will this document. To find out more about the same in detail, go through this article.

What is an Ohio Articles of Organization?

You have to compulsorily file the Ohio articles of organization with the state to procure legal existence. To conduct your business from signing a contract to registering your LLC for licenses, you will need the articles of organization. After filing, it limits the liability of shareholders and directors along with which it also provides governance. To maintain the credibility and fulfill statutory requirements of a business it is mandatory to file the form with the Ohio SOS. The form necessarily cover-ups all the details of an LLC that is present in the state.

What Information is Needed in the Articles of Organization?

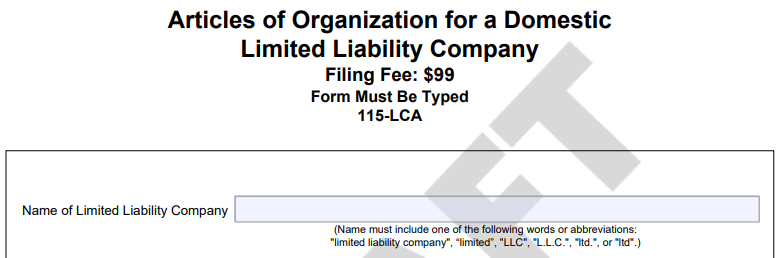

To fill up the form 115-LCA you have to follow the following steps. All the sections are mandatory to fill to showcase your presence in the Ohio articles of organization. Make sure you enter all the valid details from the name, date, details of the registered agent, members, and purpose of the LLC.

Article 1: LLC Name

Make sure you choose a valid name that is unique and does not exist in the state. If any other entity in the state has already claimed the name then you will not be able to use that. To check the availability of the name that your desire for your LLC you have to perform an Ohio business entity search. The results will help you pick a unique name then you fill out this article with the non-existing name of your LLC.

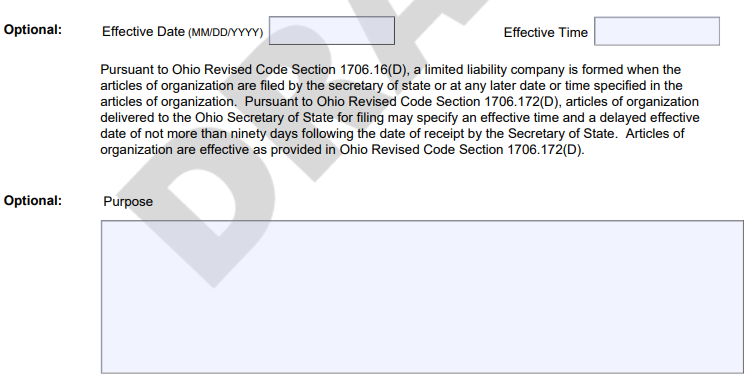

Article 2: Optional Section

There are three different sections which include the effective date, time, and purpose of your LLC. It is optional to fill out this section but we recommend you do. Make sure to state the valid date when your LLC will start. The duration can be perpetual and in that case, you can leave the section empty. You probably want to mention the purpose of why you want to form an Ohio LLC. This field is not required to fill but you can mention these details as well.

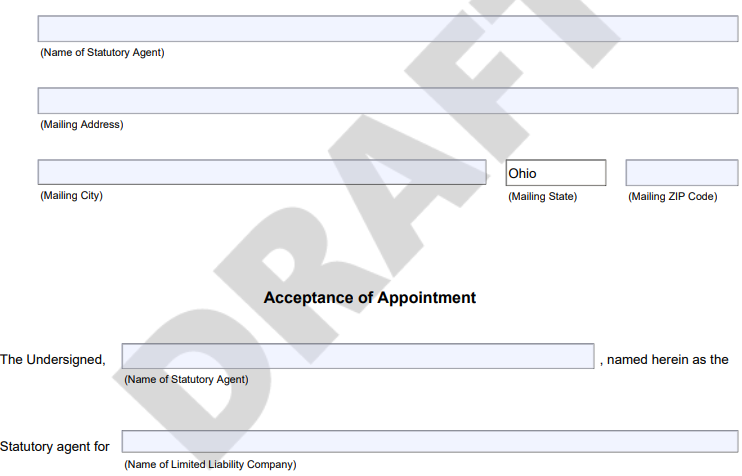

Article 3: Registered Agent

While you form an LLC in Ohio, you will have to legally appoint a registered agent. The agent can be anyone from your family and friends. You can even appoint yourself as a registered agent. You have to fill out their detail along with the address of the registered office. It is mandatory to mention their details.

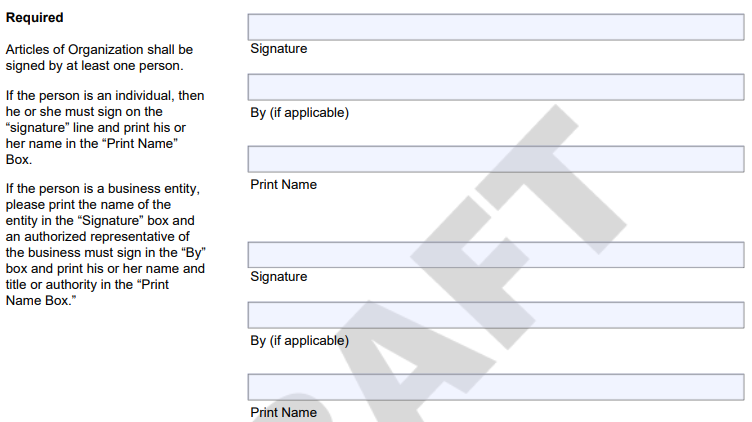

Article 4: Signatures

If there is only one owner then the signature of one person is necessary. If the ownership is divided into more than one unit then they all have to sign the form. They must agree to all the terms and conditions of the OH SOS.

How To File My Ohio Article of Organization?

When you successfully know what all fields are required while filling the form, move ahead and file it with the state. While you form an LLC in Ohio, you have to legally bind to file the Ohio articles of organization with the secretary of state. Here are the two steps – Online & Via Mail, through which you can fill the form.

Online: You can visit the SOS site and search for the organization form. They will show you the results of the LLC articles of organization form. Fill out all the required fields in the form and then submit it.

By Mail: Open the pdf format of the form and download it. You can fill out the hard copy and submit it to the Ohio secretary of state. You also mail for expedite filing to the OH SOS.

Mailing Address

P.O. Box 670

Columbus, OH 43216

Expedite Filing

P.O. Box 1390

Columbus, OH 43216

Can I Make Changes In the Ohio Articles of Organization?

Certainly, yes. You can indeed make changes in the Ohio articles of organization. Only the details of the statutory agent cannot be changed in the form which you have to it by filing a Statutory Agent update form. To change other details in the articles of organization you have to file a Form 540, a certificate of amendment with the state SOS. It will cost you a $50 fee when filing.

How Much Does OH Articles of Organization Cost?

Ohio articles of organization will cost you a $99 fee while you file it with the OH secretary of state. The expedite fees of the form are $100 if you want it within 2 days, $200 for 1 day, and $300 if you want it within 4 hours. The cost of filing the form online and via mail is the same. You just have to make sure that the fees you pay are received by the department of state to process your request.

What is the Approval Time For The Articles of Organization?

The turnaround time of the form is 3/7 business days. Whereas if you wish to claim the Ohio articles of organization before that then you have to pay an additional amount to the secretary of state. The time varies according to the demand of the type of business.

Frequently Asked Questions

It takes around 3 to 7 business days for SOS to process the articles of the organization in Ohio.

Yes, if an LLC in Ohio is divided into more than one ownership then they all have to necessarily sign the articles of organization.

As long as the SOS site of all states provides a certificate of amendment of articles of organization, you can amend in all states.

As long as you appoint a registered agent for your LLC in Ohio, you do not need to hire a separate agent to file the form. 1. How long does articles of organization takes to process in Ohio?

2. Can more than one owner sign the articles of organization in Ohio?

3. Can I amend articles of organization in all states?

4. Do I have to appoint a separate registered agent to file Ohio articles of organization?

What After My Ohio Filing Process?

Once you have successfully filed the Ohio articles of organization you must take other considerations into account. The process of forming an LLC in Ohio does not end here. Draft an Ohio operating agreement to set forth the rules and responsibilities for the members of your business. You must open a business bank account that can separate your personal assets from business liabilities. Claim an EIN for your legal name in the state. You must get a domain name and open a website to expand your business outside the state.